The Nasdaq Stock Market is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc., which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges. Although it trades stock of healthcare, financial, media, entertainment, retail, hospitality, and food businesses, it focuses more on technology stocks. The exchange is made up of both American and foreign firms, with China and Israel being the largest foreign sources.

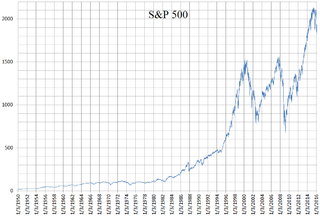

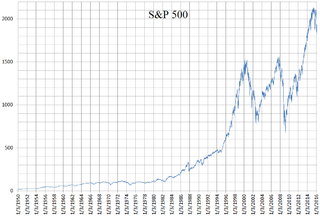

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies, with an aggregate market cap of more than $43 trillion as of January 2024.

The Korean Securities Dealers Automated Quotations is a trading board of Korea Exchange (KRX) in South Korea established in 1996. Initially set up by Korea Financial Investment Association as an independent stock market from the Korean Stock Exchange, it was benchmarked from the American counterpart, NASDAQ. KOSDAQ is an electronic stock market, just like NASDAQ. The open hours for the market are 09:00AM to 03:30PM KST.

Osaka Exchange, Inc., renamed from Osaka Securities Exchange Co., Ltd., is the largest derivatives exchange in Japan, in terms of amount of business handled.

The IBEX 35 is the benchmark stock market index of the Bolsa de Madrid, Spain's principal stock exchange. Initiated in 1992, the index is administered and calculated by Sociedad de Bolsas, a subsidiary of Bolsas y Mercados Españoles (BME), the company which runs Spain's securities markets. It is a market capitalization weighted index comprising the 35 most liquid Spanish stocks traded in the Madrid Stock Exchange General Index and is reviewed twice annually. Trading on options and futures contracts on the IBEX 35 is provided by MEFF, another subsidiary of BME.

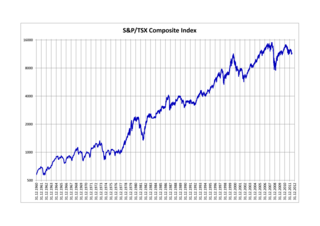

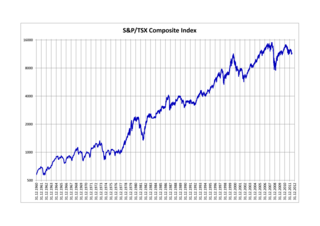

The S&P/TSX Composite Index is the benchmark Canadian stock market index representing roughly 70% of the total market capitalization on the Toronto Stock Exchange (TSX). Having replaced the TSE 300 Composite Index on May 1, 2002, as of September 20, 2021 the S&P/TSX Composite Index comprises 237 of the 3,451 companies listed on the TSX. The index reached an all-time closing high of 25,691.80 on December 6, 2024, and an intraday record high of 25,843.20 on December 9, 2024.

The Tokyo Stock Price Index, commonly known as the TOPIX, is an important stock market index for the Tokyo Stock Exchange (TSE) in Japan, along with the Nikkei 225. The TOPIX tracks the entire market of domestic companies and covers most stocks in the Prime market and some stocks in the Standard market. It is calculated and published by the TSE. As of January 2025, there are planned to be 1,716 companies listed on the TSE, since about 400 stocks with low liquidity were phased out after the TSE reform in 2022.

The Stock Exchange of Mauritius (SEM) ; is an organization responsible for the operation of Mauritius's primary stock exchange located at Port Louis. The SEM operates two markets: the Official Market and the Development & Enterprise Market (DEM). There are 40 companies listed on the Official Market representing a Market Capitalization of nearly US$5.3 billion, the DEM presently has 48 companies listed with a market capitalisation of nearly US$1.5 billion as at 31 July 2012. SEM is one of the leading Exchanges in Africa and a member of the World Federation of Exchanges.

Korea Exchange is the sole securities exchange operator in South Korea. It is headquartered in Busan, and has an office for cash markets and market oversight in Seoul.

The Tehran Stock Exchange (TSE) is Iran's largest stock exchange, which first opened in 1967. The TSE is based in Tehran. As of October 2024, 663 companies with a combined market capitalization of US$ 94 billion were listed on TSE. TSE, which is a founding member of the Federation of Euro-Asian Stock Exchanges, has been one of the world's best performing stock exchanges in the years 2002 through 2013. TSE is an emerging or "frontier" market.

Indonesia Stock Exchange (IDX) is a stock exchange based in Jakarta, Indonesia. It was previously known as the Jakarta Stock Exchange (JSX) before its name changed in 2007 after merging with the Surabaya Stock Exchange (SSX). In recent years, the Indonesian Stock Exchange has seen the fastest membership growth in Asia. As of December 2024, the Indonesia Stock Exchange had 943 listed companies, and total number of investors has already grown to 14.8 million. Indonesia Market Capitalization accounted for 45.2% of its nominal GDP in December 2020. Founded on 30 November 2007, it is ASEAN's largest market capitalization at US$881 billion as of 19 September 2024.

The S&P/ASX 200 (XJO) index is a market-capitalisation weighted and float-adjusted stock market index of stocks listed on the Australian Securities Exchange. The index is maintained by Standard & Poor's and is considered the benchmark for Australian equity performance. It is based on the 200 largest ASX listed stocks, which together account for about 82% of Australia's share market capitalisation.

A capitalization-weightedindex, also called a market-value-weighted index is a stock market index whose components are weighted according to the total market value of their outstanding shares. Every day an individual stock's price changes and thereby changes a stock index's value. The impact that individual stock's price change has on the index is proportional to the company's overall market value, in a capitalization-weighted index. In other types of indices, different ratios are used.

The Taiwan Futures Exchange was established in 1998. It offers futures and options on major Taiwan stock indices, government bond futures, equity options and 30-day CP interest rate futures.

In finance, a stock market index future is a cash-settled futures contract on the value of a particular stock market index. The turnover for the global market in exchange-traded equity index futures is notionally valued, for 2008, by the Bank for International Settlements at US$130 trillion.

The Korea Securities Computing Corporation is a Korean financial IT company that provides the IT infrastructure to the Korean financial securities and futures markets. It also provides a trading platform, market data and other financial systems for the Korean market.

In finance, a stock index, or stock market index, is an index that measures the performance of a stock market, or of a subset of a stock market. It helps investors compare current stock price levels with past prices to calculate market performance.

The KOSPI 200 is a stock market index consisting of 200 major companies listed on the Korea Exchange (KRX). It is a widely recognized benchmark for stock market activity in South Korea, weighted by free-float market capitalization.