The economy of the Czech Republic is a developed export-oriented social market economy based in services, manufacturing, and innovation that maintains a high-income welfare state and the European social model. The Czech Republic participates in the European Single Market as a member of the European Union, and is therefore a part of the economy of the European Union. It uses its own currency, the Czech koruna, instead of the euro. It is a member of the Organisation for Economic Co-operation and Development (OECD). The Czech Republic ranks 16th in inequality-adjusted human development and 24th in World Bank Human Capital Index, ahead of countries such as the United States, the United Kingdom or France. It was described by The Guardian as "one of Europe's most flourishing economies".

The economy of Indonesia is one of the emerging market economies in the world and the largest in Southeast Asia. As an upper-middle income country and member of the G20, Indonesia is classified as a newly industrialized country. Estimated at over 21 quadrillion rupiah in 2023, it is the 16th largest economy in the world by nominal GDP and the 7th largest in terms of GDP (PPP). Indonesia's internet economy reach US$77 billion in 2022, and is expected to cross the US$130 billion mark by 2025. Indonesia depends on the domestic market and government budget spending and its ownership of state-owned enterprises. The administration of prices of a range of basic goods also plays a significant role in Indonesia's market economy. However, since the 1990s, the majority of the economy has been controlled by individual Indonesians and foreign companies.

The economy of Kazakhstan is the largest in Central Asia in both absolute and per capita terms. In 2021, Kazakhstan attracted more than US$370 billion of foreign investments since becoming an independent republic after the collapse of the former Soviet Union.

The economy of Morocco is considered a relatively liberal economy, governed by the law of supply and demand. Since 1993, in line with many Western world changes; Morocco has followed a policy of privatisation of certain economic sectors which used to be in the hands of the government. Morocco has become a major player in African economic affairs, and is the 5th largest African economy by GDP (PPP). The World Economic Forum placed Morocco as the most competitive economy in North Africa, in its African Competitiveness Report 2014–2015.

The economy of Poland is an industrialized, mixed economy with a developed market that serves as the sixth-largest in the European Union by nominal GDP and fifth-largest by GDP (PPP). Poland boasts the extensive public services characteristic of most developed economies. Since 1988, Poland has pursued a policy of economic liberalization but retained an advanced public welfare system. This includes universal free public healthcare and education, extensive provisions of free public childcare and parental leave. The country is considered by many to be a successful post-communist state. It is classified as a high-income economy by the World Bank, ranking 22nd worldwide in terms of GDP (PPP), 23rd in terms of GDP (nominal), and 23rd in the 2018 Economic Complexity Index.

The economy of Slovakia is based upon Slovakia becoming an EU member state in 2004, and adopting the euro at the beginning of 2009. Its capital, Bratislava, is the largest financial centre in Slovakia. As of Q1 2018, the unemployment rate was 5.72%.

The economy of Vietnam is a developing mixed socialist-oriented market economy, which is the 36th-largest in the world as measured by nominal gross domestic product (GDP) and 26th-largest in the world as measured by purchasing power parity (PPP) in 2022. Vietnam is a member of the Asia-Pacific Economic Cooperation, the Association of Southeast Asian Nations and the World Trade Organization.

The category of newly industrialized country (NIC), newly industrialized economy (NIE) or middle income country is a socioeconomic classification applied to several countries around the world by political scientists and economists. They represent a subset of developing countries whose economic growth is much higher than other developing countries; and where the social consequences of industrialization, such as urbanization, are reorganizing society.

The economy of Africa consists of the trade, industry, agriculture, and human resources of the continent. As of 2019, approximately 1.3 billion people were living in 54 countries in Africa. Africa is a resource-rich continent. Recent growth has been due to growth in sales, commodities, services, and manufacturing. West Africa, East Africa, Central Africa and Southern Africa in particular, are expected to reach a combined GDP of $29 trillion by 2050.

The economy of Asia comprises about 4.7 billion people living in 50 different nations. Asia is the fastest growing economic region, as well as the largest continental economy by both GDP Nominal and PPP in the world. Moreover, Asia is the site of some of the world's longest modern economic booms, starting from the Japanese economic miracle (1950–1990), Miracle on the Han River (1961–1996) in South Korea, economic boom (1978–2013) in China, Tiger Cub Economies (1990–2020) in ASEAN, and economic boom in India (1991–present).

An emerging market is a market that has some characteristics of a developed market, but does not fully meet its standards. This includes markets that may become developed markets in the future or were in the past. The term "frontier market" is used for developing countries with smaller, riskier, or more illiquid capital markets than "emerging". As of 2006, the economies of China and India are considered to be the largest emerging markets. According to The Economist, many people find the term outdated, but no new term has gained traction. Emerging market hedge fund capital reached a record new level in the first quarter of 2011 of $121 billion. Emerging market economies’ share of global PPP-adjusted GDP has risen from 27 percent in 1960 to around 53 percent by 2013. The 10 largest emerging and developing economies by either nominal or PPP-adjusted GDP are 4 of the 5 BRICS countries along with Egypt, Indonesia, Mexico, South Korea, Saudi Arabia, Taiwan and Turkey.

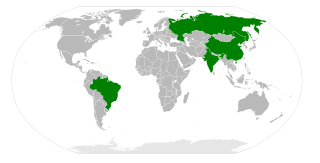

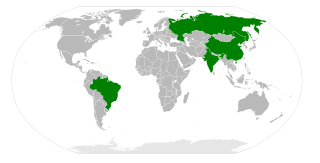

BRIC is a grouping acronym referring to the developing countries of Brazil, Russia, India, and China, which are identified as rising economic powers. It is typically rendered as "the BRIC", "the BRIC countries", "the BRIC economies", or alternatively as the "Big Four". The term was coined by economist Jim O'Neill in 2001 as an acronym for the four countries he identified as being at a similar stage of newly advanced economic development.

Đổi Mới is the name given to the economic reforms initiated in Vietnam in 1986 with the goal of creating a "socialist-oriented market economy". The term đổi mới itself is a general term with wide use in the Vietnamese language meaning "innovate" or "renovate". However, the Đổi Mới Policy refers specifically to these reforms that sought to transition Vietnam from a command economy to a socialist-oriented market economy.

The East Asian model, pioneered by Japan, is a plan for economic growth whereby the government invests in certain sectors of the economy in order to stimulate the growth of specific industries in the private sector. It generally refers to the model of development pursued in East Asian economies such as Japan, South Korea and Taiwan. It has also been used by some to describe the contemporary economic system in Mainland China after Deng Xiaoping's economic reforms during the late 1970s and the current economic system of Vietnam after its Đổi Mới policy was implemented in 1986.

CIVETS is an acronym for six emerging market countries identified for their rapid economic development: Colombia, Indonesia, Vietnam, Egypt, Turkey, and South Africa. The term was coined in 2009 by Robert Ward of the Economist Intelligence Unit to describe nations demonstrating particularly strong growth potential. Common characteristics include "diverse and dynamic" economies, "young, growing population[s]", and "relatively sophisticated financial systems".

Emerging and growth-leading economies (EAGLEs) are a grouping of key emerging markets developed by BBVA Research. The EAGLE economies are expected to lead global growth in the next 10 years, and to provide important opportunities for investors.

3G countries or Global Growth Generating countries are 11 countries which have been identified as sources of growth potential and of profitable investment opportunities.

BRICS is a grouping of the world economies of Brazil, Russia, India, China, and South Africa formed by the 2010 addition of South Africa to the predecessor BRIC. The original acronym "BRIC", or "the BRICs", was coined in 2001 by Goldman Sachs economist Jim O'Neill to describe fast-growing economies that he predicted would collectively dominate the global economy by 2050.

MINT is an acronym referring to the economies of Mexico, Indonesia, Nigeria, and Turkey. The term was originally coined in 2014 by Fidelity Investments, a Boston-based asset management firm, and was popularized by Jim O'Neill of Goldman Sachs, who had created the term BRIC. The term is primarily used in the economic and financial spheres as well as in academia. Its usage has grown specially in the investment sector, where it is used to refer to the bonds issued by these governments. These four countries are also part of the "Next Eleven".