Corporatocracy is an economic, political and judicial system controlled by business corporations or corporate interests.

Anti-capitalism is a political ideology and movement encompassing a variety of attitudes and ideas that oppose capitalism. In this sense, anti-capitalists are those who wish to replace capitalism with another type of economic system, such as socialism or communism.

Neoliberalism, also neo-liberalism, is a term used to signify the late-20th century political reappearance of 19th-century ideas associated with free-market capitalism. The term has multiple, competing definitions, and is often used pejoratively. In scholarly use, the term is frequently undefined or used to characterize a vast variety of phenomena, but is primarily used to describe the transformation of society due to market-based reforms.

Economic inequality is an umbrella term for a) income inequality or distribution of income, b) wealth inequality or distribution of wealth, and c) consumption inequality. Each of these can be measured between two or more nations, within a single nation, or between and within sub-populations.

Capital accumulation is the dynamic that motivates the pursuit of profit, involving the investment of money or any financial asset with the goal of increasing the initial monetary value of said asset as a financial return whether in the form of profit, rent, interest, royalties or capital gains. The aim of capital accumulation is to create new fixed and working capitals, broaden and modernize the existing ones, grow the material basis of social-cultural activities, as well as constituting the necessary resource for reserve and insurance. The process of capital accumulation forms the basis of capitalism, and is one of the defining characteristics of a capitalist economic system.

In Marxian economics, economic reproduction refers to recurrent processes. Michel Aglietta views economic reproduction as the process whereby the initial conditions necessary for economic activity to occur are constantly re-created. Marx viewed reproduction as the process by which society re-created itself, both materially and socially.

In economics, a cycle of poverty or poverty trap is when poverty seems to be inherited causing subsequent generations to not be able to escape it. It is caused by self-reinforcing mechanisms that cause poverty, once it exists, to persist unless there is outside intervention. It can persist across generations, and when applied to developing countries, is also known as a development trap.

Workfare is a governmental plan under which welfare recipients are required to accept public-service jobs or to participate in job training. Many countries around the world have adopted workfare to reduce poverty among able-bodied adults; however, their approaches to execution vary. The United States and United Kingdom are two countries utilizing workfare, albeit with different backgrounds.

In Marxian economics and preceding theories, the problem of primitive accumulation of capital concerns the origin of capital and therefore how class distinctions between possessors and non-possessors came to be.

Capitalism is an economic system based on the private ownership of the means of production, and their operation for profit. Other characteristics include free trade, capital accumulation, voluntary exchange, and wage labor. Its emergence, evolution, and spread are the subjects of extensive research and debate. Debates sometimes focus on how to bring substantive historical data to bear on key questions. Key parameters of debate include: the extent to which capitalism is natural, versus the extent to which it arises from specific historical circumstances; whether its origins lie in towns and trade or in rural property relations; the role of class conflict; the role of the state; the extent to which capitalism is a distinctively European innovation; its relationship with European imperialism; whether technological change is a driver or merely a secondary byproduct of capitalism; and whether or not it is the most beneficial way to organize human societies.

Criticism of capitalism is a critique of political economy that involves the rejection of, or dissatisfaction with the economic system of capitalism and its outcomes. Criticisms typically range from expressing disagreement with particular aspects or outcomes of capitalism to rejecting the principles of the capitalist system in its entirety.

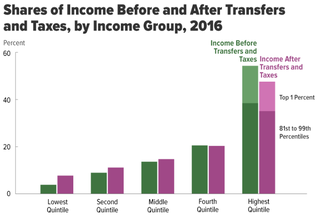

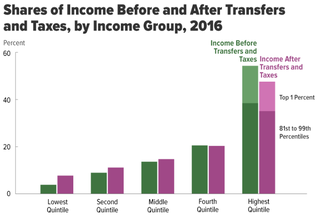

Income inequality has fluctuated considerably in the United States since measurements began around 1915, moving in an arc between peaks in the 1920s and 2000s, with a 30-year period of relatively lower inequality between 1950 and 1980.

Social inequality occurs when resources within a society are distributed unevenly, often as a result of inequitable allocation practices that create distinct unequal patterns based on socially defined categories of people. Differences in accessing social goods within society are influenced by factors like power, religion, kinship, prestige, race, ethnicity, gender, age, sexual orientation, and class. Social inequality usually implies the lack of equality of outcome, but may alternatively be conceptualized as a lack of equality in access to opportunity.

Redistribution of income and wealth is the transfer of income and wealth from some individuals to others through a social mechanism such as taxation, welfare, public services, land reform, monetary policies, confiscation, divorce or tort law. The term typically refers to redistribution on an economy-wide basis rather than between selected individuals.

The causes of poverty may vary with respect to nation, region, and in comparison with other countries at the global level. Yet, there is a commonality amongst these causes. Philosophical perspectives, and especially historical perspectives, including some factors at a micro and macro level can be considered in understanding these causes.

The commodification of nature is an area of research within critical environmental studies that is concerned with the ways in which natural entities and processes are made exchangeable through the market, and the implications thereof.

The commodification of water refers to the process of transforming water, especially freshwater, from a public good into a tradable commodity also known as an economic good. This transformation introduces water to previously unencumbered market forces in the hope of being managed more efficiently as a resource. The commodification of water has increased significantly during the 20th century in parallel with fears over water scarcity and environmental degradation.

In sociology and economics, the precariat is a neologism for a social class formed by people suffering from precarity, which means existing without predictability or security, affecting material or psychological welfare. The term is a portmanteau merging precarious with proletariat.

Economic democracy is a socioeconomic philosophy that proposes to shift ownership and decision-making power from corporate shareholders and corporate managers to a larger group of public stakeholders that includes workers, consumers, suppliers, communities and the broader public. No single definition or approach encompasses economic democracy, but most proponents claim that modern property relations externalize costs, subordinate the general well-being to private profit and deny the polity a democratic voice in economic policy decisions. In addition to these moral concerns, economic democracy makes practical claims, such as that it can compensate for capitalism's inherent effective demand gap.

Economic Violence is a form of Structural Violence in which specific groups of people are deprived of critical economic resources. Bandy X. Lee, a psychiatrist and scholar on the subject of violence, asserts that such economic impediments are among the "avoidable limitations that society places on groups of people [which] constrain them from meeting their basic needs and achieving the quality of life that would otherwise be possible." As with other forms of Structural Violence, Lee notes that it is typically inflicted by institutions to the effect of exercising power over vulnerable groups.