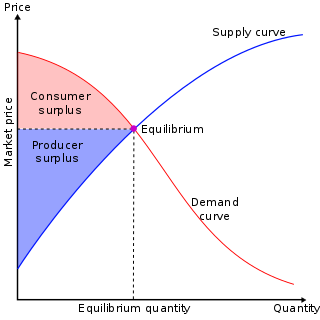

Taxes and subsidies change the price of goods and, as a result, the quantity consumed. There is a difference between an ad valorem tax and a specific tax or subsidy in the way it is applied to the price of the good. In the end levying a tax moves the market to a new equilibrium where the price of a good paid by buyers increases and the proportion of the price received by sellers decreases. The incidence of a tax does not depend on whether the buyers or sellers are taxed since taxes levied on sellers are likely to be met by raising the price charged to buyers. Most of the burden of a tax falls on the less elastic side of the market because of a lower ability to respond to the tax by changing the quantity sold or bought. Introduction of a subsidy, on the other hand, may either lowers the price of production which encourages firms to produce more, or lowers the price paid by buyers, encouraging higher sales volume. Such a policy is beneficial both to sellers and buyers.

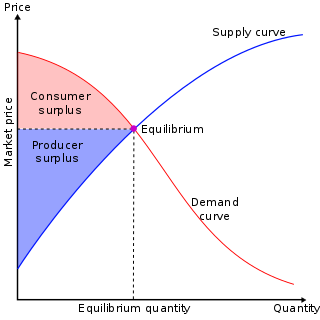

In mainstream economics, economic surplus, also known as total welfare or total social welfare or Marshallian surplus, is either of two related quantities:

A video game publisher is a company that publishes video games that have been developed either internally by the publisher or externally by a video game developer.

Price discrimination is a microeconomic pricing strategy where identical or largely similar goods or services are sold at different prices by the same provider in different market segments. Price discrimination is distinguished from product differentiation by the more substantial difference in production cost for the differently priced products involved in the latter strategy. Price differentiation essentially relies on the variation in the customers' willingness to pay and in the elasticity of their demand. For price discrimination to succeed, a firm must have market power, such as a dominant market share, product uniqueness, sole pricing power, etc. All prices under price discrimination are higher than the equilibrium price in a perfectly competitive market. However, some prices under price discrimination may be lower than the price charged by a single-price monopolist. Price discrimination is utilised by the monopolist to recapture some deadweight loss. This Pricing strategy enables firms to capture additional consumer surplus and maximize their profits while benefiting some consumers at lower prices. Price discrimination can take many forms and is prevalent in many industries, from education and telecommunications to healthcare.

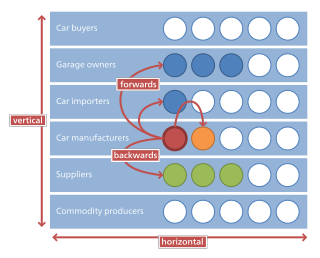

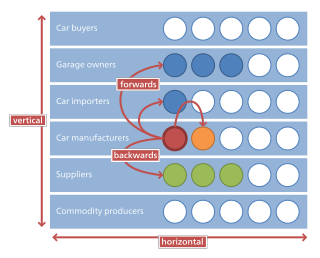

In microeconomics, management and international political economy, vertical integration is an arrangement in which the supply chain of a company is integrated and owned by that company. Usually each member of the supply chain produces a different product or (market-specific) service, and the products combine to satisfy a common need. It contrasts with horizontal integration, wherein a company produces several items that are related to one another. Vertical integration has also described management styles that bring large portions of the supply chain not only under a common ownership but also into one corporation.

The list price, also known as the manufacturer's suggested retail price (MSRP), or the recommended retail price (RRP), or the suggested retail price (SRP) of a product is the price at which its manufacturer notionally recommends that a retailer sell the product.

Allocative efficiency is a state of the economy in which production is aligned with consumer preferences; in particular, the set of outputs is chosen so as to maximize the wellbeing of society. This is achieved if every good or service is produced up until the last unit provides a marginal benefit to consumers equal to the marginal cost of production.

Managerial economics is a branch of economics involving the application of economic methods in the organizational decision-making process. Economics is the study of the production, distribution, and consumption of goods and services. Managerial economics involves the use of economic theories and principles to make decisions regarding the allocation of scarce resources. It guides managers in making decisions relating to the company's customers, competitors, suppliers, and internal operations.

Extended producer responsibility (EPR) is a strategy to add all of the estimated environmental costs associated with a product throughout the product life cycle to the market price of that product, contemporarily mainly applied in the field of waste management. Such societal costs are typically externalities to market mechanisms, with a common example being the impact of cars.

Business-to-business is a situation where one business makes a commercial transaction with another. This typically occurs when:

Demand response is a change in the power consumption of an electric utility customer to better match the demand for power with the supply. Until the 21st century decrease in the cost of pumped storage and batteries electric energy could not be easily stored, so utilities have traditionally matched demand and supply by throttling the production rate of their power plants, taking generating units on or off line, or importing power from other utilities. There are limits to what can be achieved on the supply side, because some generating units can take a long time to come up to full power, some units may be very expensive to operate, and demand can at times be greater than the capacity of all the available power plants put together. Demand response, a type of energy demand management, seeks to adjust in real-time the demand for power instead of adjusting the supply.

In economics, tax incidence or tax burden is the effect of a particular tax on the distribution of economic welfare. Economists distinguish between the entities who ultimately bear the tax burden and those on whom the tax is initially imposed. The tax burden measures the true economic effect of the tax, measured by the difference between real incomes or utilities before and after imposing the tax, and taking into account how the tax causes prices to change. For example, if a 10% tax is imposed on sellers of butter, but the market price rises 8% as a result, most of the tax burden is on buyers, not sellers. The concept of tax incidence was initially brought to economists' attention by the French Physiocrats, in particular François Quesnay, who argued that the incidence of all taxation falls ultimately on landowners and is at the expense of land rent. Tax incidence is said to "fall" upon the group that ultimately bears the burden of, or ultimately suffers a loss from, the tax. The key concept of tax incidence is that the tax incidence or tax burden does not depend on where the revenue is collected, but on the price elasticity of demand and price elasticity of supply. As a general policy matter, the tax incidence should not violate the principles of a desirable tax system, especially fairness and transparency. The concept of tax incidence is used in political science and sociology to analyze the level of resources extracted from each income social stratum in order to describe how the tax burden is distributed among social classes. That allows one to derive some inferences about the progressive nature of the tax system, according to principles of vertical equity.

Merger control refers to the procedure of reviewing mergers and acquisitions under antitrust / competition law. Over 130 nations worldwide have adopted a regime providing for merger control. National or supernational competition agencies such as the EU European Commission or the US Federal Trade Commission are normally entrusted with the role of reviewing mergers.

Asymmetric price transmission refers to pricing phenomenon occurring when downstream prices react in a different manner to upstream price changes, depending on the characteristics of upstream prices or changes in those prices.

The Commerce Commission is a New Zealand government agency with responsibility for enforcing legislation that relates to competition in the country's markets, fair trading and consumer credit contracts, and regulatory responsibility for areas such as electricity and gas, telecommunications, dairy products and airports. It is an independent Crown entity established under the Commerce Act 1986. Although responsible to the Minister of Commerce and Consumer Affairs and the Minister of Broadcasting, Communications and Digital Media, the Commission is run independently from the government, and is intended to be an impartial promotor and enforcer of the law.

Baxter's law is a law of economics that describes how a monopoly in a regulated industry can extend into, and dominate, a non-regulated industry. It is named after law professor William Francis Baxter Jr., who was an antitrust law professor at Stanford University. As Assistant Attorney General, he settled a seven-year-old case against AT&T with by far the largest breakup in the history of the Sherman Antitrust Act, splitting AT&T up into seven regional phone companies in 1982.

In the United Kingdom, an electricity supplier is a retailer of electricity. For each supply point the supplier has to pay the various costs of transmission, distribution, meter operation, data collection, tax etc. The supplier then adds in energy costs and the supplier's own charge. Regulation of the charging of customers is covered by the industry regulator Ofgem.

Market foreclosure or vertical foreclosure, is the production limitation put on a producing organisation if either it is denied access to a supplier, or it is denied access to a downstream buyer. A supplier or intermediary in a supply chain could acquire this form of market power against competitors through means of mergers and acquisitions. This amalgamation of suppliers and customers demonstrates vertical integration along a value chain with various strategic and efficiency benefits including elimination of successive monopoly markups and lowering transaction costs.

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities.

Double marginalization is a vertical externality that occurs when two firms with market power, at different vertical levels in the same supply chain, apply a mark-up to their prices. This is caused by the prospect of facing a steep demand curve slope, prompting the firm to mark-up the price beyond its marginal costs. Double marginalization is clearly negative from a welfare point of view, as the double markup induces a deadweight loss, because the retail price is higher than the optimal monopoly price a vertically integrated company would set, leading to underproduction. Thus all social groups are negatively affected because the overall profit for the company is lower, the consumer has to pay more and a smaller amount of units are consumed.