The Villages is a census-designated place (CDP) in Sumter and Marion counties in the U.S. state of Florida. It shares its name with a broader master-planned age-restricted community that spreads into portions of Lake County. The overall development lies in central Florida, approximately 20 miles (32 km) south of Ocala and approximately 45 miles (72 km) northwest of Orlando. As of the 2020 census, the population of the CDP was 79,077.

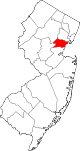

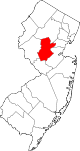

Berkeley Heights is a township in Union County, in the U.S. state of New Jersey. A commuter town in northern-central New Jersey, Berkeley Heights is nestled within the Raritan Valley region bordering both Morris and Somerset counties. As of the 2020 United States census, the township's population was 13,285, an increase of 102 (+0.8%) from the 2010 census count of 13,183, which in turn reflected a decline of 224 (−1.7%) from the 13,407 counted in the 2000 census.

Powell is a city in the U.S. state of Ohio, located 14 miles (21.5 km) north of the state capital of Columbus. The city is located in Delaware County; a frequent placeholder on the List of highest-income counties in the United States, and 35th wealthiest county in the United States in 2020. Powell had an estimated population of 14,163 at the 2020 census. Founded in the early 1800s, it is now a growing suburb of Columbus. Per the U.S. Census Bureau, 73.5% of Powell residents over the age of 25 are college graduates, the median home value is $372,700, and the median household income is $157,149. In 2018, the median list price of a home within the City of Powell was $411,173.

A homeowner association, or a homeowner community, is a private association-like entity in the United States, Canada, and certain other countries often formed either ipso jure in a building with multiple owner-occupancies, or by a real estate developer for the purpose of marketing, managing, and selling homes and lots in a residential subdivision. The developer will typically transfer control of the association to the homeowners after selling a predetermined number of lots.

A property tax is an ad valorem tax on the value of a property.

The administrative divisions of New York are the various units of government that provide local services in the U.S. State of New York. The state is divided into boroughs, counties, cities, towns, and villages. They are municipal corporations, chartered (created) by the New York State Legislature, as under the New York State Constitution the only body that can create governmental units is the state. All of them have their own governments, sometimes with no paid employees, that provide local services. Centers of population that are not incorporated and have no government or local services are designated hamlets. Whether a municipality is defined as a borough, city, town, or village is determined not by population or land area, but rather on the form of government selected by the residents and approved by the New York State Legislature. Each type of local government is granted specific home rule powers by the New York State Constitution. There are still occasional changes as a village becomes a city, or a village dissolves, each of which requires legislative action. New York also has various corporate entities that provide local services and have their own administrative structures (governments), such as school and fire districts. These are not found in all counties.

Most U.S. states and territories have at least two tiers of local government: counties and municipalities. Louisiana uses the term parish and Alaska uses the term borough for what the U.S. Census Bureau terms county equivalents in those states. Civil townships or towns are used as subdivisions of a county in 20 states, mostly in the Northeast and Midwest.

The homestead exemption is a legal regime to protect the value of the homes of residents from property taxes, creditors, and circumstances that arise from the death of the homeowner's spouse.

The homestead exemption in Florida may refer to three different types of homestead exemptions under Florida law:

- exemption from forced sale before and at death per Art. X, Section 4(a)-(b) of the Florida Constitution;

- restrictions on devise and alienation, Art. X, Section 4(c) of the Florida Constitution;

- and exemption from taxation per Art. VII, Section 6 of the Florida Constitution.

Hollin Hills is a historic district and neighborhood in southeast Fairfax County, Virginia. It is located primarily in the Fort Hunt area of the county with some portions remaining in the Hybla Valley and Groveton areas since a shift for census purposes prior to 2010. The community contains more than 30 acres (12 ha) of parkland across seven distinct parks, a pool and swim club, a bocce court, and a pickleball and tennis club, operated and maintained by the Civic Association of Hollin Hills (CAHH).

The Oneida Indian Nation (OIN) or Oneida Nation is a federally recognized tribe of Oneida people in the United States. The tribe is headquartered in Verona, New York, where the tribe originated and held territory prior to European colonialism, and continues to hold territory today. They are Iroquoian-speaking people, and one of the Five Nations of the Iroquois Confederacy, or Haudenosaunee. Three other federally recognized Oneida tribes operate in locations where they migrated or were removed to during and after the American Revolutionary War: one in Wisconsin in the United States, and two in Ontario, Canada.

Ono Island is a 5.5-mile (8.9 km) long barrier island located in southern Baldwin County, Alabama, United States, at the mouth of Perdido Bay near the Gulf of Mexico. It is bordered by Bayou St. John to the north and Old River to the south. Surrounding communities include Perdido Key, Florida to the south and east and Orange Beach, Alabama to the south and west.

The administrative divisions of Wisconsin include counties, cities, villages and towns. In Wisconsin, all of these are units of general-purpose local government. There are also a number of special-purpose districts formed to handle regional concerns, such as school districts.

Optimal tax theory or the theory of optimal taxation is the study of designing and implementing a tax that maximises a social welfare function subject to economic constraints. The social welfare function used is typically a function of individuals' utilities, most commonly some form of utilitarian function, so the tax system is chosen to maximise the aggregate of individual utilities. Tax revenue is required to fund the provision of public goods and other government services, as well as for redistribution from rich to poor individuals. However, most taxes distort individual behavior, because the activity that is taxed becomes relatively less desirable; for instance, taxes on labour income reduce the incentive to work. The optimization problem involves minimizing the distortions caused by taxation, while achieving desired levels of redistribution and revenue. Some taxes are thought to be less distorting, such as lump-sum taxes and Pigouvian taxes, where the market consumption of a good is inefficient, and a tax brings consumption closer to the efficient level.

The General Electric Realty Plot, often referred to locally as the GE Realty Plot, GE Plots or just The Plot, is a residential neighborhood in Schenectady, New York, United States. It is an area of approximately 90 acres (36 ha) just east of Union College.

Most local governments in the United States impose a property tax, also known as a millage rate, as a principal source of revenue. This tax may be imposed on real estate or personal property. The tax is nearly always computed as the fair market value of the property, multiplied by an assessment ratio, multiplied by a tax rate, and is generally an obligation of the owner of the property. Values are determined by local officials, and may be disputed by property owners. For the taxing authority, one advantage of the property tax over the sales tax or income tax is that the revenue always equals the tax levy, unlike the other types of taxes. The property tax typically produces the required revenue for municipalities' tax levies. One disadvantage to the taxpayer is that the tax liability is fixed, while the taxpayer's income is not.

Bolton Hall was an American lawyer, author, and georgism activist who worked on behalf of the poor and started the back-to-the-land movement in the United States at the beginning of the 20th century.

Taxes in Germany are levied by the federal government, the states (Länder) as well as the municipalities (Städte/Gemeinden). Many direct and indirect taxes exist in Germany; income tax and VAT are the most significant.

New Moti Bagh is a residential colony in South Delhi. New Moti Bagh occupies an area of 143 acres, in the exclusive New Delhi Municipal Council (NDMC) area of New Delhi. It is one of Delhi's most expensive areas, where land rates vary from 10 lakhs to 12 lakhs a square yard.

Oak Hill is a ghost town in Bastrop County, Texas, United States. It is located 4 miles southwest of McDade, 12 miles southeast of Elgin, 13 miles northeast of Bastrop, and 37 miles southeast of Austin on the old Bastrop-McDade Road.