Density

Suppose that a random variable  has gamma distribution with mean

has gamma distribution with mean  and shape parameter

and shape parameter  , with

, with  being treated as a random variable having another gamma distribution, this time with mean

being treated as a random variable having another gamma distribution, this time with mean  and shape parameter

and shape parameter  . The result is that

. The result is that  has the following probability density function (pdf) for

has the following probability density function (pdf) for  :

:

where  is a modified Bessel function of the second kind. Note that for the modified Bessel function of the second kind, we have

is a modified Bessel function of the second kind. Note that for the modified Bessel function of the second kind, we have  . In this derivation, the K-distribution is a compound probability distribution. It is also a product distribution: it is the distribution of the product of two independent random variables, one having a gamma distribution with mean 1 and shape parameter

. In this derivation, the K-distribution is a compound probability distribution. It is also a product distribution: it is the distribution of the product of two independent random variables, one having a gamma distribution with mean 1 and shape parameter  , the second having a gamma distribution with mean

, the second having a gamma distribution with mean  and shape parameter

and shape parameter  .

.

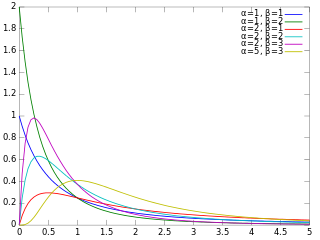

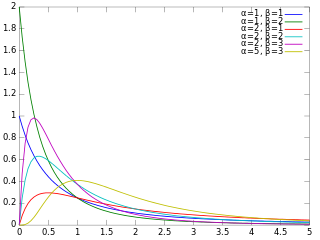

A simpler two parameter formalization of the K-distribution can be obtained by setting  as

as

where  is the shape factor,

is the shape factor,  is the scale factor, and

is the scale factor, and  is the modified Bessel function of second kind. The above two parameter formalization can also be obtained by setting

is the modified Bessel function of second kind. The above two parameter formalization can also be obtained by setting  ,

,  , and

, and  , albeit with different physical interpretation of

, albeit with different physical interpretation of  and

and  parameters. This two parameter formalization is often referred to as the K-distribution, while the three parameter formalization is referred to as the generalized K-distribution.

parameters. This two parameter formalization is often referred to as the K-distribution, while the three parameter formalization is referred to as the generalized K-distribution.

This distribution derives from a paper by Eric Jakeman and Peter Pusey (1978) who used it to model microwave sea echo. Jakeman and Tough (1987) derived the distribution from a biased random walk model. Keith D. Ward (1981) derived the distribution from the product for two random variables, z = ay, where a has a chi distribution and y a complex Gaussian distribution. The modulus of z, |z|, then has K-distribution.

The moment generating function is given by

where

and

and  is the Whittaker function.

is the Whittaker function.

The n-th moments of K-distribution is given by

So the mean and variance are given by

In probability theory and statistics, the beta distribution is a family of continuous probability distributions defined on the interval [0, 1] or in terms of two positive parameters, denoted by alpha (α) and beta (β), that appear as exponents of the variable and its complement to 1, respectively, and control the shape of the distribution.

In probability theory and statistics, the gamma distribution is a two-parameter family of continuous probability distributions. The exponential distribution, Erlang distribution, and chi-squared distribution are special cases of the gamma distribution. There are two equivalent parameterizations in common use:

- With a shape parameter and a scale parameter .

- With a shape parameter and an inverse scale parameter , called a rate parameter.

In probability theory and statistics, the Gumbel distribution is used to model the distribution of the maximum of a number of samples of various distributions.

In probability theory, a distribution is said to be stable if a linear combination of two independent random variables with this distribution has the same distribution, up to location and scale parameters. A random variable is said to be stable if its distribution is stable. The stable distribution family is also sometimes referred to as the Lévy alpha-stable distribution, after Paul Lévy, the first mathematician to have studied it.

In probability theory and statistics, the generalized extreme value (GEV) distribution is a family of continuous probability distributions developed within extreme value theory to combine the Gumbel, Fréchet and Weibull families also known as type I, II and III extreme value distributions. By the extreme value theorem the GEV distribution is the only possible limit distribution of properly normalized maxima of a sequence of independent and identically distributed random variables. Note that a limit distribution needs to exist, which requires regularity conditions on the tail of the distribution. Despite this, the GEV distribution is often used as an approximation to model the maxima of long (finite) sequences of random variables.

In probability theory and statistics, the generalized inverse Gaussian distribution (GIG) is a three-parameter family of continuous probability distributions with probability density function

In probability theory and statistics, the beta prime distribution is an absolutely continuous probability distribution. If has a beta distribution, then the odds has a beta prime distribution.

The normal-inverse Gaussian distribution is a continuous probability distribution that is defined as the normal variance-mean mixture where the mixing density is the inverse Gaussian distribution. The NIG distribution was noted by Blaesild in 1977 as a subclass of the generalised hyperbolic distribution discovered by Ole Barndorff-Nielsen. In the next year Barndorff-Nielsen published the NIG in another paper. It was introduced in the mathematical finance literature in 1997.

Expected shortfall (ES) is a risk measure—a concept used in the field of financial risk measurement to evaluate the market risk or credit risk of a portfolio. The "expected shortfall at q% level" is the expected return on the portfolio in the worst of cases. ES is an alternative to value at risk that is more sensitive to the shape of the tail of the loss distribution.

In statistics, the generalized Pareto distribution (GPD) is a family of continuous probability distributions. It is often used to model the tails of another distribution. It is specified by three parameters: location , scale , and shape . Sometimes it is specified by only scale and shape and sometimes only by its shape parameter. Some references give the shape parameter as .

A ratio distribution is a probability distribution constructed as the distribution of the ratio of random variables having two other known distributions. Given two random variables X and Y, the distribution of the random variable Z that is formed as the ratio Z = X/Y is a ratio distribution.

In probability and statistics, the truncated normal distribution is the probability distribution derived from that of a normally distributed random variable by bounding the random variable from either below or above. The truncated normal distribution has wide applications in statistics and econometrics.

Tail value at risk (TVaR), also known as tail conditional expectation (TCE) or conditional tail expectation (CTE), is a risk measure associated with the more general value at risk. It quantifies the expected value of the loss given that an event outside a given probability level has occurred.

In probability and statistics, the log-logistic distribution is a continuous probability distribution for a non-negative random variable. It is used in survival analysis as a parametric model for events whose rate increases initially and decreases later, as, for example, mortality rate from cancer following diagnosis or treatment. It has also been used in hydrology to model stream flow and precipitation, in economics as a simple model of the distribution of wealth or income, and in networking to model the transmission times of data considering both the network and the software.

The Birnbaum–Saunders distribution, also known as the fatigue life distribution, is a probability distribution used extensively in reliability applications to model failure times. There are several alternative formulations of this distribution in the literature. It is named after Z. W. Birnbaum and S. C. Saunders.

The shifted log-logistic distribution is a probability distribution also known as the generalized log-logistic or the three-parameter log-logistic distribution. It has also been called the generalized logistic distribution, but this conflicts with other uses of the term: see generalized logistic distribution.

The term generalized logistic distribution is used as the name for several different families of probability distributions. For example, Johnson et al. list four forms, which are listed below.

In probability theory and statistics, the normal-inverse-gamma distribution is a four-parameter family of multivariate continuous probability distributions. It is the conjugate prior of a normal distribution with unknown mean and variance.

The generalized normal distribution or generalized Gaussian distribution (GGD) is either of two families of parametric continuous probability distributions on the real line. Both families add a shape parameter to the normal distribution. To distinguish the two families, they are referred to below as "symmetric" and "asymmetric"; however, this is not a standard nomenclature.

The Lomax distribution, conditionally also called the Pareto Type II distribution, is a heavy-tail probability distribution used in business, economics, actuarial science, queueing theory and Internet traffic modeling. It is named after K. S. Lomax. It is essentially a Pareto distribution that has been shifted so that its support begins at zero.