Global Trust Bank (Uganda) Limited (GTBU), commonly referred to as Global Trust Bank (GTBU), was a commercial bank in Uganda which started operations in 2008 and was closed down in 2014. Its headquarters were located in a five-storey building on Kampala Road in the center of Uganda’s capital, Kampala. It was licensed as a commercial bank by Bank of Uganda, the central bank and national banking regulator.

I&M Bank Uganda, formerly Orient Bank, whose complete name is I&M Bank (Uganda) Limited, is a commercial bank in Uganda which is licensed by the Bank of Uganda (BOU), the central bank and national banking regulator.

Stanbic Bank Uganda Limited (SBU) is a commercial bank in Uganda and is licensed by the Bank of Uganda, the central bank and national banking regulator.

DFCU Bank, registered as the Development Finance Company of Uganda Bank Limited, is a commercial bank in Uganda. It is licensed by the Bank of Uganda (BoU), Uganda's central bank and national banking regulator.

Bank of Africa Uganda Limited, also known as BOA Uganda (BOAU), is one of the commercial banks in Uganda that have been licensed by the Bank of Uganda, the country's central bank and national banking regulator.

The Bank of Baroda Uganda Limited (BOBU), is a commercial bank in Uganda that is majority owned by the Indian government owned banking and financial service conglomerate Bank of Baroda. BOBU is one of the commercial banks licensed by the Bank of Uganda, the central bank and national banking regulator.

Ecobank Uganda is a bank in Uganda that operates as a commercial bank under a license granted by the Bank of Uganda, the central bank and national banking regulator.

The Uganda Development Bank Limited (UDBL) is a government-owned development financial institution in Uganda.

Cairo Bank Uganda Limited (CBUL), formerly known as Cairo International Bank (CIB), is a commercial bank in Uganda. It is licensed by the Bank of Uganda, the central bank and national banking regulator. It is a subsidiary of Egypt-based banking group, Banque du Caire Group.

PostBank Uganda is a commercial bank in Uganda, licensed and supervised by the Bank of Uganda, the country's central bank and national banking regulator. The bank received her tier-1 banking license in December 2021.

Absa Bank Uganda Limited, formerly known as Barclays Bank of Uganda Limited, is a commercial bank in Uganda. It is licensed by the Bank of Uganda, the country's central bank and national banking regulator. The bank is a subsidiary of Absa Group Limited, a financial services conglomerate, based in South Africa, with banking subsidiaries in 12 African countries and representative offices in two other African countries. Absa Bank Group, whose shares trade on the JSE Limited, was reported to have total assets in excess of US$91 billion, as of October 2019.

United Bank for Africa Uganda Limited, also UBA Uganda, is a commercial bank in Uganda. It is licensed by the Bank of Uganda, the central bank and national banking regulator. UBA Uganda is a subsidiary of the United Bank for Africa, headquartered in Lagos, Nigeria, with a presence in twenty African countries, the United Kingdom, France, and the United States. The stock of UBA Transnational trades on the Nigeria Stock Exchange under the symbol UBA.

Pride Microfinance Limited (PMFL), is a microfinance deposit-taking institution (MDI) in Uganda. It is licensed by the Bank of Uganda, the central bank and national banking regulator.

Finance Trust Bank (FTB), commonly called Finance Trust, is a commercial bank in Uganda. It is licensed by the Bank of Uganda, the central bank and national banking regulator.

Opportunity Bank Uganda Limited (OBUL), is a Tier II credit institution in Uganda. It was previously registered as a commercial bank by the Bank of Uganda, the central bank and national banking regulator. The institution received a commercial banking license on 25 September 2019.

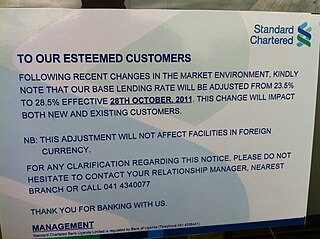

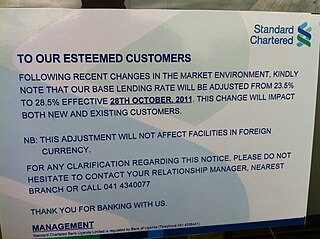

Standard Chartered Uganda, whose official name is Standard Chartered Bank Uganda Limited but is often referred to as Stanchart Uganda, is a commercial bank in Uganda. It is one of the banks licensed by the Bank of Uganda, the central bank and national banking regulator.

FINCA Uganda Limited, also known as FINCA Uganda, is a microfinance deposit-accepting institution (MDI) in Uganda. It is licensed and regulated by the Bank of Uganda, the central bank and national banking regulator.

Letshego Microfinance Uganda,, whose official name is Letshego Uganda Limited, is a Tier IV microfinance institution in Uganda.

EFC Uganda Limited (EFCUL), also known as EFC Uganda, was a microfinance deposit-taking institution (MDI) in Uganda whose license was withdrawn and liquidated by Bank of Uganda on 19 January 2024.

Michael Karokora Mugabi, is a Ugandan lawyer and corporate executive, who serves as the managing director and chief executive officer of Housing Finance Bank (HFB), a commercial and mortgage bank headquartered in Kampala, Uganda's capital city. The bank is co-owned by the Uganda National Social Security Fund and the Uganda Ministry of Finance, Planning and Economic Development.