Microeconomics is a branch of economics that studies the behavior of individuals and firms in making decisions regarding the allocation of scarce resources and the interactions among these individuals and firms. Microeconomics focuses on the study of individual markets, sectors, or industries as opposed to the national economy as a whole, which is studied in macroeconomics.

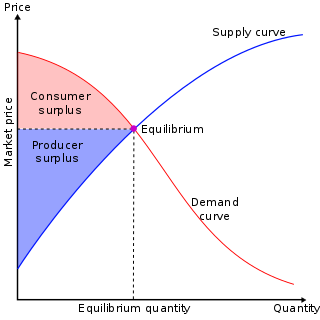

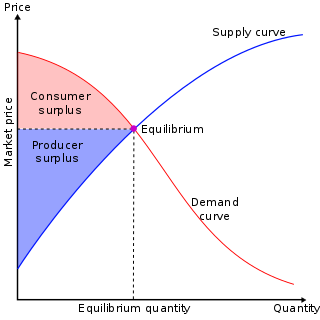

In microeconomics, supply and demand is an economic model of price determination in a market. It postulates that, holding all else equal, in a competitive market, the unit price for a particular good or other traded item such as labor or liquid financial assets, will vary until it settles at a point where the quantity demanded will equal the quantity supplied, resulting in an economic equilibrium for price and quantity transacted. The concept of supply and demand forms the theoretical basis of modern economics.

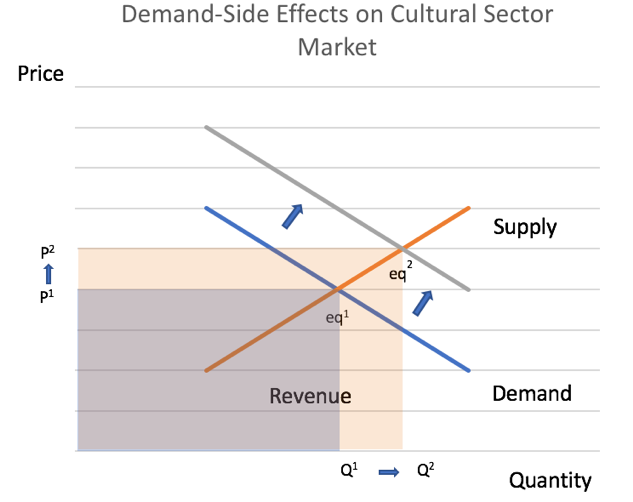

Taxes and subsidies change the price of goods and, as a result, the quantity consumed. There is a difference between an ad valorem tax and a specific tax or subsidy in the way it is applied to the price of the good. In the end levying a tax moves the market to a new equilibrium where the price of a good paid by buyers increases and the proportion of the price received by sellers decreases. The incidence of a tax does not depend on whether the buyers or sellers are taxed since taxes levied on sellers are likely to be met by raising the price charged to buyers. Most of the burden of a tax falls on the less elastic side of the market because of a lower ability to respond to the tax by changing the quantity sold or bought. Introduction of a subsidy, on the other hand, may either lowers the price of production which encourages firms to produce more, or lowers the price paid by buyers, encouraging higher sales volume. Such a policy is beneficial both to sellers and buyers.

In economics, deadweight loss is the difference in production and consumption of any given product or service including government tax. The presence of deadweight loss is most commonly identified when the quantity produced relative to the amount consumed differs in regards to the optimal concentration of surplus. This difference in the amount reflects the quantity that is not being utilized or consumed and thus resulting in a loss. This "deadweight loss" is therefore attributed to both producers and consumers because neither one of them benefits from the surplus of the overall production.

In mainstream economics, economic surplus, also known as total welfare or total social welfare or Marshallian surplus, is either of two related quantities:

The IS–LM model, or Hicks–Hansen model, is a two-dimensional macroeconomic model which is used as a pedagogical tool in macroeconomic teaching. The IS–LM model shows the relationship between interest rates and output in the short run in a closed economy. The intersection of the "investment–saving" (IS) and "liquidity preference–money supply" (LM) curves illustrates a "general equilibrium" where supposed simultaneous equilibria occur in both the goods and the money markets. The IS–LM model shows the importance of various demand shocks on output and consequently offers an explanation of changes in national income in the short run when prices are fixed or sticky. Hence, the model can be used as a tool to suggest potential levels for appropriate stabilisation policies. It is also used as a building block for the demand side of the economy in more comprehensive models like the AD–AS model.

This aims to be a complete article list of economics topics:

A subsidy or government incentive is a type of government expenditure for individuals and households, as well as businesses with the aim of stabilizing the economy. It ensures that individuals and households are viable by having access to essential goods and services while giving businesses the opportunity to stay afloat and/or competitive. Subsidies not only promote long term economic stability but also help governments to respond to economic shocks during a recession or in response to unforeseen shocks, such as the COVID-19 pandemic.

The National Endowment for the Arts (NEA) is an independent agency of the United States federal government that offers support and funding for projects exhibiting artistic excellence. It was created in 1965 as an independent agency of the federal government by an act of the U.S. Congress, signed by President Lyndon B. Johnson on September 29, 1965. It is a sub-agency of the National Foundation on the Arts and the Humanities, along with the National Endowment for the Humanities, the Federal Council on the Arts and the Humanities, and the Institute of Museum and Library Services.

A demand curve is a graph depicting the inverse demand function, a relationship between the price of a certain commodity and the quantity of that commodity that is demanded at that price. Demand curves can be used either for the price-quantity relationship for an individual consumer, or for all consumers in a particular market.

Government spending or expenditure includes all government consumption, investment, and transfer payments. In national income accounting, the acquisition by governments of goods and services for current use, to directly satisfy the individual or collective needs of the community, is classed as government final consumption expenditure. Government acquisition of goods and services intended to create future benefits, such as infrastructure investment or research spending, is classed as government investment. These two types of government spending, on final consumption and on gross capital formation, together constitute one of the major components of gross domestic product.

In economics, crowding out is a phenomenon that occurs when increased government involvement in a sector of the market economy substantially affects the remainder of the market, either on the supply or demand side of the market.

A price floor is a government- or group-imposed price control or limit on how low a price can be charged for a product, good, commodity, or service. It is one type of price support; other types include supply regulation and guarantee government purchase price. A price floor must be higher than the equilibrium price in order to be effective. The equilibrium price, commonly called the "market price", is the price where economic forces such as supply and demand are balanced and in the absence of external influences the (equilibrium) values of economic variables will not change, often described as the point at which quantity demanded and quantity supplied are equal. Governments use price floors to keep certain prices from going too low.

In economics, tax incidence or tax burden is the effect of a particular tax on the distribution of economic welfare. Economists distinguish between the entities who ultimately bear the tax burden and those on whom the tax is initially imposed. The tax burden measures the true economic effect of the tax, measured by the difference between real incomes or utilities before and after imposing the tax, and taking into account how the tax causes prices to change. For example, if a 10% tax is imposed on sellers of butter, but the market price rises 8% as a result, most of the tax burden is on buyers, not sellers. The concept of tax incidence was initially brought to economists' attention by the French Physiocrats, in particular François Quesnay, who argued that the incidence of all taxation falls ultimately on landowners and is at the expense of land rent. Tax incidence is said to "fall" upon the group that ultimately bears the burden of, or ultimately suffers a loss from, the tax. The key concept of tax incidence is that the tax incidence or tax burden does not depend on where the revenue is collected, but on the price elasticity of demand and price elasticity of supply. As a general policy matter, the tax incidence should not violate the principles of a desirable tax system, especially fairness and transparency. The concept of tax incidence is used in political science and sociology to analyze the level of resources extracted from each income social stratum in order to describe how the tax burden is distributed among social classes. That allows one to derive some inferences about the progressive nature of the tax system, according to principles of vertical equity.

The Indian government has, since war, subsidised many industries and products, from fuel to gas.

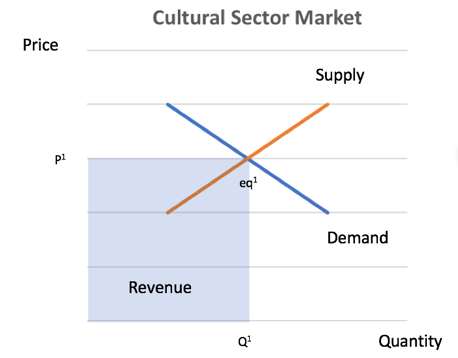

Economics of the arts and literature or cultural economics is a branch of economics that studies the economics of creation, distribution, and the consumption of works of art, literature and similar creative and/or cultural products. For a long time, the concept of the "arts" were confined to visual arts and performing arts in the Anglo-Saxon tradition. Usage has widened since the beginning of the 1980s with the study of cultural industry and the economy of cultural institutions. The field is coded as JEL: Z11 in the Journal of Economic Literature classification system used for article searches.

Cultural policy is the government actions, laws and programs that regulate, protect, encourage and financially support activities related to the arts and creative sectors, such as painting, sculpture, music, dance, literature, and filmmaking, among others and culture, which may involve activities related to language, heritage and diversity. The idea of cultural policy was developed at UNESCO in the 1960s. Generally, this involves governments setting in place processes, legal classifications, regulations, legislation and institutions which promote and facilitate cultural diversity and creative expressions in a range of art forms and creative activities. Cultural policies vary from one country to another, but generally they aim to improve the accessibility of arts and creative activities to citizens and promote the artistic, musical, ethnic, sociolinguistic, literary and other expressions of all people in a country. In some countries, especially since the 1970s, there is an emphasis on supporting the culture of Indigenous peoples and marginalized communities and ensuring that cultural industries are representative of a country's diverse cultural heritage and ethnic and linguistic demographics.

In economics, an excess supply, economic surplus market surplus or briefly supply is a situation in which the quantity of a good or service supplied is more than the quantity demanded, and the price is above the equilibrium level determined by supply and demand. That is, the quantity of the product that producers wish to sell exceeds the quantity that potential buyers are willing to buy at the prevailing price. It is the opposite of an economic shortage.

Farm programs can be part of a concentrated effort to boost a country’s agricultural productivity in general or in specific sectors where they may have a comparative advantage. There are many different types of farm programs, with a variety of objectives and created with different economic mechanisms in mind. Some are meant to benefit farmers directly, while others seek to benefit consumers. They target food prices and quantity of food available on the market, as well as production and consumption of certain goods. Some are meant to benefit farmers directly, while others seek to benefit consumers. They target food prices and quantity of food available on the market, as well as production and consumption of certain goods.

This glossary of economics is a list of definitions of terms and concepts used in economics, its sub-disciplines, and related fields.