Related Research Articles

Natural capital is the world's stock of natural resources, which includes geology, soils, air, water and all living organisms. Some natural capital assets provide people with free goods and services, often called ecosystem services. All of these underpin our economy and society, and thus make human life possible.

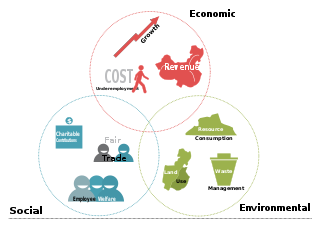

The triple bottom line is an accounting framework with three parts: social, environmental and economic. Some organizations have adopted the TBL framework to evaluate their performance in a broader perspective to create greater business value. Business writer John Elkington claims to have coined the phrase in 1994.

Corporate social responsibility (CSR) or corporate social impact is a form of international private business self-regulation which aims to contribute to societal goals of a philanthropic, activist, or charitable nature by engaging in, with, or supporting professional service volunteering through pro bono programs, community development, administering monetary grants to non-profit organizations for the public benefit, or to conduct ethically oriented business and investment practices. While once it was possible to describe CSR as an internal organizational policy or a corporate ethic strategy similar to what is now known today as Environmental, Social, Governance (ESG); that time has passed as various companies have pledged to go beyond that or have been mandated or incentivized by governments to have a better impact on the surrounding community. In addition, national and international standards, laws, and business models have been developed to facilitate and incentivize this phenomenon. Various organizations have used their authority to push it beyond individual or industry-wide initiatives. In contrast, it has been considered a form of corporate self-regulation for some time, over the last decade or so it has moved considerably from voluntary decisions at the level of individual organizations to mandatory schemes at regional, national, and international levels. Moreover, scholars and firms are using the term "creating shared value", an extension of corporate social responsibility, to explain ways of doing business in a socially responsible way while making profits.

Puma SE is a German multinational corporation who design and manufacture athletic and casual footwear, apparel, and accessories, headquartered in Herzogenaurach, Bavaria, Germany. Puma is the third largest sportswear manufacturer in the world. The company was founded in 1948 by Rudolf Dassler (1898–1974). In 1924, Rudolf and his brother Adolf "Adi" Dassler had jointly formed the company Gebrüder Dassler Schuhfabrik. The relationship between the two brothers deteriorated until they agreed to split in 1948, forming two separate entities, Adidas and Puma. Following the split, Rudolf originally registered the newly established company as Ruda, but later changed the name to Puma. Puma's earliest logo consisted of a square and beast jumping through a D, which was registered, along with the company's name, in 1948. Puma's shoe and clothing designs feature the Puma logo and the distinctive "Formstrip" which was introduced in 1958.

Genuine progress indicator (GPI) is a metric that has been suggested to replace, or supplement, gross domestic product (GDP). The GPI is designed to take fuller account of the well-being of a nation, only a part of which pertains to the size of the nation's economy, by incorporating environmental and social factors which are not measured by GDP. For instance, some models of GPI decrease in value when the poverty rate increases. The GPI separates the concept of societal progress from economic growth.

A green economy is an economy that aims at reducing environmental risks and ecological scarcities, and that aims for sustainable development without degrading the environment. It is closely related with ecological economics, but has a more politically applied focus. The 2011 UNEP Green Economy Report argues "that to be green, an economy must not only be efficient, but also fair. Fairness implies recognizing global and country level equity dimensions, particularly in assuring a Just Transition to an economy that is low-carbon, resource efficient, and socially inclusive."

Novo Nordisk A/S is a Danish multinational pharmaceutical company headquartered in Bagsværd with production facilities in nine countries and affiliates or offices in five countries. Novo Nordisk is controlled by majority shareholder Novo Holdings A/S which holds approximately 28% of its shares and a majority (77%) of its voting shares.

Volcom is a lifestyle brand that designs, markets, and distributes boardsports-oriented products. Volcom is headquartered in Costa Mesa, California, U.S. The brand is known for its trademark stone logo, its slogan True to This, and the Let the Kids Ride Free campaign. Todd Hymel is the CEO of Volcom.

A sustainable business, or a green business, is an enterprise which has a minimal negative impact or potentially a positive effect on the global or local environment, community, society, or economy—a business that attempts to meet the triple bottom line. They cluster under different groupings and the whole is sometimes referred to as "green capitalism". Often, sustainable businesses have progressive environmental and human rights policies. In general, a business is described as green if it matches the following four criteria:

- It incorporates principles of sustainability into each of its business decisions.

- It supplies environmentally friendly products or services that replace demand for nongreen products and/or services.

- It is greener than traditional competition.

- It has made an enduring commitment to environmental principles in its business operations.

Kering is a French multinational holding company specializing in luxury goods, headquartered in Paris. It owns the brands Yves Saint Laurent, Gucci, Balenciaga, Bottega Veneta, Creed, Maui Jim, and Alexander McQueen.

François-Henri Pinault is a French businessman, the son of billionaire François Pinault. François-Henri took the reins of his father's retail conglomerate Pinault-Printemps-Redoute in 2005, and turned it into the luxury group Kering in 2013. He has been president of the family-owned investment holding Groupe Artémis since 2003. He has been married to the film producer and actress Salma Hayek since 2009.

Jochen Zeitz is a businessman serving as the president, CEO and chairman of the board of Harley-Davidson, Inc. He is also Chairman of LiveWire Inc. Before that, he served as the chairman and CEO of Puma for 18 years. He also served as board member of Kering, the luxury goods company and chaired their Sustainability Committee, for whom he developed its global sustainability strategy. Zeitz is currently a board member of Harley Davidson, The B Team and Cranemere. In addition to this, Zeitz previously served on the board of Wilderness Safaris. Jochen Zeitz is also the co-founder of The B Team with Richard Branson, Zeitz Museum of Contemporary Art Africa and Founder of the Zeitz Foundation to support sustainable solutions that balance conservation, community, culture and commerce, and The Long Run.

John Elkington is an author, advisor and serial entrepreneur. He is an authority on corporate responsibility and sustainable development. He has written and co-authored 20 books, including the Green Consumer Guide, Cannibals with Forks: The Triple Bottom Line of 21st Century Business, The Power of Unreasonable People: How Social Entrepreneurs Create Markets That Change the World, and The Breakthrough Challenge: 10 Ways to Connect Tomorrow's Profits with Tomorrow's Bottom Line.

Valuation risk is the risk that an entity suffers a loss when trading an asset or a liability due to a difference between the accounting value and the price effectively obtained in the trade.

Sustainability accounting originated in the 1970s and is considered a subcategory of financial accounting that focuses on the disclosure of non-financial information about a firm's performance to external stakeholders, such as capital holders, creditors, and other authorities. Sustainability accounting represents the activities that have a direct impact on society, environment, and economic performance of an organisation. Sustainability accounting in managerial accounting contrasts with financial accounting in that managerial accounting is used for internal decision making and the creation of new policies that will have an effect on the organisation's performance at economic, ecological, and social level. Sustainability accounting is often used to generate value creation within an organisation.

The Economics of Ecosystems and Biodiversity (TEEB) was a study led by Pavan Sukhdev from 2007 to 2011. It is an international initiative to draw attention to the global economic benefits of biodiversity. Its objective is to highlight the growing cost of biodiversity loss and ecosystem degradation and to draw together expertise from the fields of science, economics and policy to enable practical actions. TEEB aims to assess, communicate and mainstream the urgency of actions through its five deliverables—D0: science and economic foundations, policy costs and costs of inaction, D1: policy opportunities for national and international policy-makers, D2: decision support for local administrators, D3: business risks, opportunities and metrics and D4: citizen and consumer ownership.

The B Team is a global nonprofit initiative co-founded by Sir Richard Branson and Jochen Zeitz. It advocates for business practices that are more centered on humanity and the climate.

Ecopreneurship is a term coined to represent the process of principles of entrepreneurship being applied to create businesses that solve environmental problems or operate sustainably. The term began to be widely used in the 1990s, and it is otherwise referred to as "environmental entrepreneurship." In the book Merging Economic and Environmental Concerns Through Ecopreneurship, written by Gwyn Schuyler in 1998, ecopreneurs are defined as follows:

"Ecopreneurs are entrepreneurs whose business efforts are not only driven by profit, but also by a concern for the environment. Ecopreneurship, also known as environmental entrepreneurship and eco-capitalism, is becoming more widespread as a new market-based approach to identifying opportunities for improving environmental quality and capitalizing upon them in the private sector for profit. "

Context-Based Sustainability (CBS) – also known as Context-Based Accounting – is an open-source, triple/multi-bottom-line, integrated accounting methodology for measuring, managing, assessing and reporting the performance of organizations relative to upper and lower limits in, and demands for, vital resources in the world. As such, CBS is a performance accounting system that interprets performance through a sustainability lens, according to which impacts are sustainable if and only if, when generalized to a broader/responsible population, they would have the effect of preserving, producing and/or maintaining vital capitals at levels required to ensure human well-being. Impacts that would have the opposite effect are unsustainable, as are the activities that produce them.

Jacqueline Amy Jackson is a British artist who lives and works in East London. She graduated in 2008 from the Ruskin School of Drawing and Fine Art, University of Oxford, England and later returned to study Sustainable Finance at Smith School of Enterprise and the Environment, University of Oxford.

References

- ↑ "Puma Reveals Its £124m Ecological Footprint". 19 November 2011.

- ↑ Confino, Jo (16 May 2011). "Puma world's first major company to put a value on its environmental impact". the Guardian.

- ↑ Anderson, Richard (16 May 2011). "Puma reveals environmental impact". BBC News.

- ↑ "Puma costs environmental impact". BBC News. 16 November 2011.

- ↑ Guevarra, Leslie (18 November 2011). "Gucci, YSL to Follow Puma in Revealing Environmental Impact Costs".

- ↑ "Supply chain weighs on Puma's first green accounts". 17 May 2011.

- ↑ Kering (May 19, 2015). "Kering Open-Sources Environmental Profit and Loss Account Methodology to Catalyse Corporate Natural Capital Accounting" . Retrieved 13 August 2016– via CSRWire.

- ↑ "Kering Environmental Profit & Loss" (PDF). Retrieved 13 August 2016.

- ↑ "Novo Nordisk's environmental profit and loss account" (PDF). 2014. Retrieved 13 August 2016.

- ↑ "Methodology report for Novo Nordisk's environmental profit and loss account" (PDF). 2014. Retrieved 13 August 2016.

- ↑ https://www.philips.com/c-dam/corporate/about-philips/sustainability/downloads/ecovision-methodologies/EPL-Account-methodology-2017.pdf [ dead link ]

- ↑ "U.K. Government White Paper Calls for Tracking Green Losses, Gains". 22 June 2011.

- ↑ "Put a value on nature!".

- ↑ John Elkington; Charmian Love; Alastair Morton. "The Future Quotient". CR Magazine. Archived from the original on 11 January 2012.

- ↑ Yvon Chouinard; Jib Ellison; Rick Ridgeway (October 2011). "The Sustainable Economy" (PDF). The Harvard Business Review. Archived from the original (PDF) on 2011-11-12.

- ↑ "Connecting Heart to Head (SSIR)".

- ↑ ThePrincesA4S (21 December 2011). "Jochen Zeitz, CEO Sport and Lifestyle Group, CSO of PPR and Chairman of the Board of Puma" – via YouTube.

{{cite web}}: CS1 maint: numeric names: authors list (link) - ↑ "Connecting Finance and Natural Capital, Case Study for eftec: Natural Capital Statements".

- ↑ "Kering and Parsons School of Design Develop Free EP&L App for Fashion Students". 18 January 2017.

- ↑ Assessment of potentials and limitations in valuation of externalities (PDF). 2014. ISBN 978-87-93178-33-5.

- ↑ Nathalie Olsen Head. "The Case for Environmental Profit and Loss Accounting" (PDF). IUCN.