This article needs additional citations for verification .(January 2026) |

| Country | United States |

|---|---|

| Value | $100 |

| Width | 157 mm |

| Height | 66.3 mm |

| Weight | ≈ 1.0 [1] g |

| Security features | Security fibers, watermark, 3D security ribbon, security thread, color shifting ink, microprinting, raised printing, EURion constellation |

| Material used | 75% cotton 25% linen |

| Years of printing | 1861–present |

| Obverse | |

| |

| Design | Benjamin Franklin's portrait by Joseph Duplessis, Declaration of Independence, quill pen, Syng inkwell with an embedded image of the Liberty Bell |

| Design date | 2009 |

| Reverse | |

| |

| Design | Independence Hall |

| Design date | 2009 |

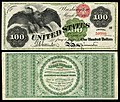

The United States one-hundred-dollar bill (US$100) is a denomination of United States currency. The first United States Note with this value was issued in 1862 and the Federal Reserve Note version was first produced in 1914. [2] Inventor and U.S. Founding Father Benjamin Franklin has been featured on the obverse of the bill since 1914, [3] which now also contains stylized images of the Declaration of Independence, a quill pen, the Syng inkwell, and the Liberty Bell. The reverse depicts Independence Hall in Philadelphia, Pennsylvania, which it has featured since 1928. [3]

Contents

- History

- Large-size notes

- Small size notes

- Series dates

- Withdrawal of large denomination bills ($500 and up)

- References

- Further reading

- External links

The $100 bill is the largest denomination that has been printed and circulated since July 13, 1969, when the larger denominations of $500, $1,000, $5,000, and $10,000 were retired. [4] As of December 2018, [update] the average life of a $100 bill in circulation is 22.9 years before it is replaced due to wear.[ citation needed ]

The bills are also commonly referred to as "Bens", "Benjamins", or "Franklins", in reference to the use of Benjamin Franklin's portrait by the French painter Joseph Duplessis on the denomination,[ citation needed ] as "C-Notes" or "Century Notes", based on the Roman numeral for 100,[ citation needed ] or as "blue faces", based on the blue tint of Franklin's face in the current design.[ citation needed ] The bill is one of two denominations printed today that does not feature a president of the United States, the other being the $10 bill, featuring Alexander Hamilton. The Series 2009$100 bill redesign was unveiled on April 21, 2010, and was issued to the public on October 8, 2013. The new bill costs 12.6 cents to produce[ citation needed ] and has a blue ribbon woven into the center of the currency with "100" and Liberty Bells, alternating, that appear when the bill is tilted.

As of June 30, 2012, the $100 bill comprised 77% of all US currency in circulation. [5] Federal Reserve data from 2017 showed that the number of $100 bills exceeded the number of $1 bills. However, a 2018 research paper by the Federal Reserve Bank of Chicago estimated that 80 percent of $100 bills were in other countries. Possible reasons included $100 bills being used as a reserve currency against economic instability that affected other currencies, and use for criminal activities. [6]