Solar power in Nevada is growing due to a Renewable Portfolio Standard which requires 50% renewable energy by 2030. The state has abundant open land areas and some of the best solar potential in the country.

Solar power in New Mexico in 2016 generated 2.8% of the state's total electricity consumption, despite a National Renewable Energy Laboratory (NREL) projection suggesting a potential contribution three orders of magnitude larger.

New York has a renewable portfolio standard of 30% from renewable sources by 2015. In 2015 24% was renewable, 6% short of the goal. Wind is the predominant generating technology. In 2018, the New York State Energy Research and Development Authority awarded long-term contracts to 22 utility-scale solar farms, totaling a combined capacity of 646 MW.

Solar power has been increasing rapidly in the U.S. state of North Carolina, from less than 1 MW (megawatts) in 2007 to 6,152 MW in 2019, when it had the second-largest installed PV capacity of all states.

Solar power in Nebraska is used for only a very small percentage of the state's electricity, although it is rapidly becoming competitive with grid electricity, due to the decrease in cost and the eight-year extension to the 30% tax credit, which can be used to install systems of any size. In 2015, the state ranked 47th among the 50 U.S. states with 1.1 MW of installed capacity.

As of the first quarter of 2023, Washington State has 604 MW of solar power electricity generation. This is an increase from about 300 MW in 2021 and 27 MW in 2013.

Solar power in Louisiana is ranked 34th for installed solar PV capacity as of 2017 by the Solar Energy Industry Association. The state's "solar friendliness" according to Solar Power Rocks has fallen to 50th place for 2018 as the state credit program ends and full 1:1 retail net metering is being phased out. Taxpayers still benefit from federal incentive programs such as the 30 percent tax credit, which applies to business and residential solar photovoltaic and thermal energy systems of any size.

Solar power in Kentucky has been growing in recent years due to new technological improvements and a variety of regulatory actions and financial incentives, particularly a 30% federal tax credit, available through 2016, for any size project. Kentucky could generate 10% of all of the electricity used in the United States from land cleared from coal mining in the state. Covering just one-fifth with photovoltaics would supply all of the state's electricity.

Solar power in Ohio has been increasing, as the cost of photovoltaics has decreased. Ohio installed 10 MW of solar in 2015. Ohio adopted a net metering rule which allows any customer generating up to 25 kW to use net metering, with the kilowatt hour surplus rolled over each month, and paid by the utility once a year at the generation rate upon request. For hospitals there is no limit on size, but two meters are required, one for generation, the other for utility supplied power.

The U.S. state of Utah has the solar potential to provide all of the electricity used in the United States. Utah is one of the seven states with the best potential for solar power, along with California, Nevada, Arizona, New Mexico, Colorado, and Texas. Utah's only investor owned utility currently allows partial net metering for residential systems up to 25 kW and up to 2 MW for non-residential users. In the past RMP allowed full net metering, and partial net metering. Neither of these Schedules allows for new customers to sign up any longer. Utah's municipal utilities and electric cooperatives set their own net metering policies.

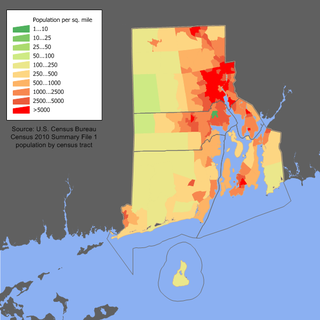

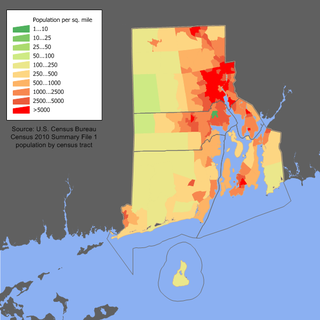

Solar power in Rhode Island has become economical due to new technological improvements and a variety of regulatory actions and financial incentives, particularly a 30% federal tax credit, available through 2016, for any size project. A typical residential installation could pay for itself in utility bill savings in 14 years, and generate a profit for the remainder of its 25 year life. Larger systems, from 10 kW to 5 MW, receive a feed-in tariff of up to 33.45¢/kWh.

Mississippi has substantial potential for solar power, though it remains an underutilized generation method. The rate of installations has increased in recent years, reaching 438 MW of installed capacity in early 2023, ranking 36th among the states. Rooftop photovoltaics could provide 31.2% of all electricity used in Mississippi from 11,700 MW if solar panels were installed on every available roof.

Solar power in Maine on rooftops, utilizing 6,300 megawatts (MW) of solar panels, can provide 60% of the electricity used in Maine according to a 2016 U.S. Department of Energy study. Maine and Vermont are tied for the second highest rooftop solar potential in the country, only behind the state of California. A 2020 estimate suggests that a typical 5.6 kilowatt (kW) residential system will pay for itself in 6-7 years and generate a profit of $45,000 over the rest of its 25-year life from the tax credits and utility savings.

Solar power in Georgia on rooftops can provide 31% of all electricity used in Georgia.

Solar power in Maryland is supported by the state's legislation regarding the Renewable Portfolio Standard and Solar Renewable Energy Credit (SREC) program. The target for renewable energy as of 2017 is 20% by 2020, including 2% from solar power.

Solar power in Missouri has been a growing industry since the early 2010s. Solar power is capable of generating 42.7% of the electricity used in Missouri from rooftop solar panels totaling 28,300 MW.

Solar power in New Hampshire provides a small percentage of the state's electricity. State renewable requirements and declining prices have led to some installations. Photovoltaics on rooftops can provide 53.4% of all electricity used in New Hampshire, from 5,300 MW of solar panels, and 72% of the electricity used in Concord, New Hampshire. A 2016 estimate suggests that a typical 5 kW system costing $25,000 before credits and utility savings will pay for itself in 9 years, and generate a profit of $34,196 over the rest of its 25-year life. A loan or lease provides a net savings each year, including the first year. New Hampshire has a rebate program which pays $0.75/W for residential systems up to 5 kW, for up to 50% of the system cost, up to $3,750. However, New Hampshire's solar installation lagged behind nearby states such as Vermont and New York, which in 2013 had 10 times and 25 times more solar, respectively.

Solar power in Vermont provides almost 11% of the state's in-state electricity production as of 2018. A 2009 study indicated that distributed solar on rooftops can provide 18% of all electricity used in Vermont. A 2012 estimate suggests that a typical 5 kW system costing $25,000 before credits and utility savings will pay for itself in 10 years, and generate a profit of $34,956 over the rest of its 25-year life.

Solar power in Wisconsin In 2026, Wisconsin rooftops can accommodate approximately 37 GWs of solar capacity and produce 44,183 GWh of electricity, nearly 70% of the statewide generation in 2019. Net metering is available for systems up to at least 20 kW, and excess generation is credited at retail rate to customers next bill. Some utilities allow net metering up to 100 kW. For Xcel customers, kilowatt credits are rolled over monthly and are reconciled annually at avoided cost. Best practices recommend no limits, either individually or aggregate, and perpetual roll over of kilowatt credits.

Solar power in Delaware is small industry. Delaware had 150 MW of total installed capacity in 2020. The largest solar farms in the state included the 10 MW Dover Sun Park and the 12 MW Milford Solar Farm.