Pareto efficiency or Pareto optimality is a situation where no action or allocation is available that makes one individual better off without making another worse off. The concept is named after Vilfredo Pareto (1848–1923), Italian civil engineer and economist, who used the concept in his studies of economic efficiency and income distribution. The following three concepts are closely related:

The Pareto distribution, named after the Italian civil engineer, economist, and sociologist Vilfredo Pareto, is a power-law probability distribution that is used in description of social, quality control, scientific, geophysical, actuarial, and many other types of observable phenomena; the principle originally applied to describing the distribution of wealth in a society, fitting the trend that a large portion of wealth is held by a small fraction of the population. The Pareto principle or "80-20 rule" stating that 80% of outcomes are due to 20% of causes was named in honour of Pareto, but the concepts are distinct, and only Pareto distributions with shape value of log45 ≈ 1.16 precisely reflect it. Empirical observation has shown that this 80-20 distribution fits a wide range of cases, including natural phenomena and human activities.

In mathematics, an inequality is a relation which makes a non-equal comparison between two numbers or other mathematical expressions. It is used most often to compare two numbers on the number line by their size. There are several different notations used to represent different kinds of inequalities:

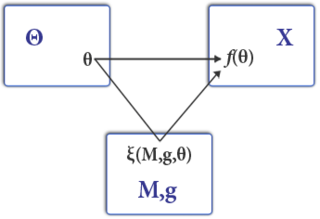

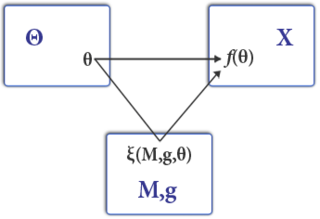

Mechanism design is a field in economics and game theory that takes an objectives-first approach to designing economic mechanisms or incentives, toward desired objectives, in strategic settings, where players act rationally. Because it starts at the end of the game, then goes backwards, it is also called reverse game theory. It has broad applications, from economics and politics in such fields as market design, auction theory and social choice theory to networked-systems.

There are two fundamental theorems of welfare economics. The first states that in economic equilibrium, a set of complete markets, with complete information, and in perfect competition, will be Pareto optimal. The requirements for perfect competition are these:

- There are no externalities and each actor has perfect information.

- Firms and consumers take prices as given.

The Myerson–Satterthwaite theorem is an important result in mechanism design and the economics of asymmetric information, and named for Roger Myerson and Mark Satterthwaite. Informally, the result says that there is no efficient way for two parties to trade a good when they each have secret and probabilistically varying valuations for it, without the risk of forcing one party to trade at a loss.

Competitive equilibrium is a concept of economic equilibrium, introduced by Kenneth Arrow and Gérard Debreu in 1951, appropriate for the analysis of commodity markets with flexible prices and many traders, and serving as the benchmark of efficiency in economic analysis. It relies crucially on the assumption of a competitive environment where each trader decides upon a quantity that is so small compared to the total quantity traded in the market that their individual transactions have no influence on the prices. Competitive markets are an ideal standard by which other market structures are evaluated.

In social choice theory, a dictatorship mechanism is a rule by which, among all possible alternatives, the results of voting mirror a single pre-determined person's preferences, without consideration of the other voters. Dictatorship by itself is not considered a good mechanism in practice, but it is theoretically important: by Arrow's impossibility theorem, when there are at least three alternatives, dictatorship is the only ranked voting electoral system that satisfies unrestricted domain, Pareto efficiency, and independence of irrelevant alternatives. Similarly, by Gibbard's theorem, when there are at least three alternatives, dictatorship is the only strategyproof rule.

Strategic network formation defines how and why networks take particular forms. In many networks, the relation between nodes is determined by the choice of the participating players involved, not by an arbitrary rule. A "strategic2 modeling of network requires defining a network’s costs and benefits and predicts how individual preferences become outcomes.

Efficient cake-cutting is a problem in economics and computer science. It involves a heterogeneous resource, such as a cake with different toppings or a land with different coverings, that is assumed to be divisible - it is possible to cut arbitrarily small pieces of it without destroying their value. The resource has to be divided among several partners who have different preferences over different parts of the cake, i.e., some people prefer the chocolate toppings, some prefer the cherries, some just want as large a piece as possible, etc. The allocation should be economically efficient. Several notions of efficiency have been studied:

Group envy-freeness is a criterion for fair division. A group-envy-free division is a division of a resource among several partners such that every group of partners feel that their allocated share is at least as good as the share of any other group with the same size. The term is used particularly in problems such as fair resource allocation, fair cake-cutting and fair item allocation.

Envy-freeness, also known as no-envy, is a criterion for fair division. It says that, when resources are allocated among people with equal rights, each person should receive a share that is, in their eyes, at least as good as the share received by any other agent. In other words, no person should feel envy.

Efficiency and fairness are two major goals of welfare economics. Given a set of resources and a set of agents, the goal is to divide the resources among the agents in a way that is both Pareto efficient (PE) and envy-free (EF). The goal was first defined by David Schmeidler and Menahem Yaari. Later, the existence of such allocations has been proved under various conditions.

Utilitarian cake-cutting is a rule for dividing a heterogeneous resource, such as a cake or a land-estate, among several partners with different cardinal utility functions, such that the sum of the utilities of the partners is as large as possible. It is a special case of the utilitarian social choice rule. Utilitarian cake-cutting is often not "fair"; hence, utilitarianism is often in conflict with fair cake-cutting.

Envy-free (EF) item allocation is a fair item allocation problem, in which the fairness criterion is envy-freeness - each agent should receive a bundle that they believe to be at least as good as the bundle of any other agent.

Random priority (RP), also called Random serial dictatorship (RSD), is a procedure for fair random assignment - dividing indivisible items fairly among people.

A simultaneous eating algorithm(SE) is an algorithm for allocating divisible objects among agents with ordinal preferences. "Ordinal preferences" means that each agent can rank the items from best to worst, but cannot (or does not want to) specify a numeric value for each item. The SE allocation satisfies SD-efficiency - a weak ordinal variant of Pareto-efficiency (it means that the allocation is Pareto-efficient for at least one vector of additive utility functions consistent with the agents' item rankings).

When allocating objects among people with different preferences, two major goals are Pareto efficiency and fairness. Since the objects are indivisible, there may not exist any fair allocation. For example, when there is a single house and two people, every allocation of the house will be unfair to one person. Therefore, several common approximations have been studied, such as maximin-share fairness (MMS), envy-freeness up to one item (EF1), proportionality up to one item (PROP1), and equitability up to one item (EQ1). The problem of efficient approximately-fair item allocation is to find an allocation that is both Pareto-efficient (PE) and satisfies one of these fairness notions. The problem was first presented at 2016 and has attracted considerable attention since then.

In economics and computer science, Fractional Pareto efficiency or Fractional Pareto optimality (fPO) is a variant of Pareto efficiency used in the setting of fair allocation of discrete objects. An allocation of objects is called discrete if each item is wholly allocated to a single agent; it is called fractional if some objects are split among two or more agents. A discrete allocation is called Pareto-efficient (PO) if it is not Pareto-dominated by any discrete allocation; it is called fractionally Pareto-efficient (fPO) if it is not Pareto-dominated by any discrete or fractional allocation. So fPO is a stronger requirement than PO: every fPO allocation is PO, but not every PO allocation is fPO.

Ordinal Pareto efficiency refers to several adaptations of the concept of Pareto-efficiency to settings in which the agents only express ordinal utilities over items, but not over bundles. That is, agents rank the items from best to worst, but they do not rank the subsets of items. In particular, they do not specify a numeric value for each item. This may cause an ambiguity regarding whether certain allocations are Pareto-efficient or not. As an example, consider an economy with three items and two agents, with the following rankings: