In probability theory, the expected value is a generalization of the weighted average. Informally, the expected value is the arithmetic mean of the possible values a random variable can take, weighted by the probability of those outcomes. Since it is obtained through arithmetic, the expected value sometimes may not even be included in the sample data set; it is not the value you would "expect" to get in reality.

The following outline is provided as an overview of and topical guide to statistics:

In probability theory and related fields, a stochastic or random process is a mathematical object usually defined as a sequence of random variables in a probability space, where the index of the sequence often has the interpretation of time. Stochastic processes are widely used as mathematical models of systems and phenomena that appear to vary in a random manner. Examples include the growth of a bacterial population, an electrical current fluctuating due to thermal noise, or the movement of a gas molecule. Stochastic processes have applications in many disciplines such as biology, chemistry, ecology, neuroscience, physics, image processing, signal processing, control theory, information theory, computer science, and telecommunications. Furthermore, seemingly random changes in financial markets have motivated the extensive use of stochastic processes in finance.

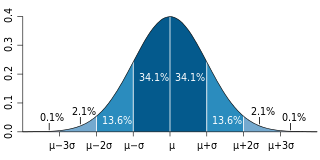

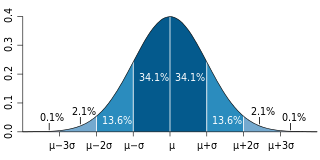

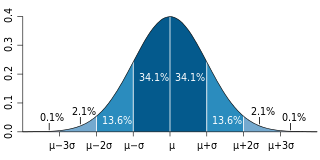

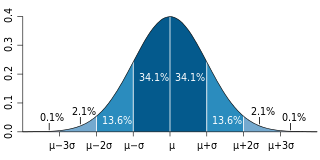

In probability theory, Chebyshev's inequality provides an upper bound on the probability of deviation of a random variable from its mean. More specifically, the probability that a random variable deviates from its mean by more than is at most , where is any positive constant and is the standard deviation.

In probability theory, the law of large numbers (LLN) is a mathematical theorem that states that the average of the results obtained from a large number of independent and identical random samples converges to the true value, if it exists. More formally, the LLN states that given a sample of independent and identically distributed values, the sample mean converges to the true mean.

In probability theory, a martingale is a sequence of random variables for which, at a particular time, the conditional expectation of the next value in the sequence is equal to the present value, regardless of all prior values.

Probability is a measure of the likeliness that an event will occur. Probability is used to quantify an attitude of mind towards some proposition whose truth is not certain. The proposition of interest is usually of the form "A specific event will occur." The attitude of mind is of the form "How certain is it that the event will occur?" The certainty that is adopted can be described in terms of a numerical measure, and this number, between 0 and 1 is called the probability. Probability theory is used extensively in statistics, mathematics, science and philosophy to draw conclusions about the likelihood of potential events and the underlying mechanics of complex systems.

In probability theory, the law of the iterated logarithm describes the magnitude of the fluctuations of a random walk. The original statement of the law of the iterated logarithm is due to A. Ya. Khinchin (1924). Another statement was given by A. N. Kolmogorov in 1929.

In probability theory, a zero–one law is a result that states that an event must have probability 0 or 1 and no intermediate value. Sometimes, the statement is that the limit of certain probabilities must be 0 or 1.

This glossary of statistics and probability is a list of definitions of terms and concepts used in the mathematical sciences of statistics and probability, their sub-disciplines, and related fields. For additional related terms, see Glossary of mathematics and Glossary of experimental design.

In probability theory, the theory of large deviations concerns the asymptotic behaviour of remote tails of sequences of probability distributions. While some basic ideas of the theory can be traced to Laplace, the formalization started with insurance mathematics, namely ruin theory with Cramér and Lundberg. A unified formalization of large deviation theory was developed in 1966, in a paper by Varadhan. Large deviations theory formalizes the heuristic ideas of concentration of measures and widely generalizes the notion of convergence of probability measures.

In probability theory, Donsker's theorem, named after Monroe D. Donsker, is a functional extension of the central limit theorem for empirical distribution functions. Specifically, the theorem states that an appropriately centered and scaled version of the empirical distribution function converges to a Gaussian process.

This page lists articles related to probability theory. In particular, it lists many articles corresponding to specific probability distributions. Such articles are marked here by a code of the form (X:Y), which refers to number of random variables involved and the type of the distribution. For example (2:DC) indicates a distribution with two random variables, discrete or continuous. Other codes are just abbreviations for topics. The list of codes can be found in the table of contents.

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling in the financial field.

This page is based on this

Wikipedia article Text is available under the

CC BY-SA 4.0 license; additional terms may apply.

Images, videos and audio are available under their respective licenses.