In probability theory and related fields, a stochastic or random process is a mathematical object usually defined as a sequence of random variables, where the index of the sequence has the interpretation of time. Stochastic processes are widely used as mathematical models of systems and phenomena that appear to vary in a random manner. Examples include the growth of a bacterial population, an electrical current fluctuating due to thermal noise, or the movement of a gas molecule. Stochastic processes have applications in many disciplines such as biology, chemistry, ecology, neuroscience, physics, image processing, signal processing, control theory, information theory, computer science, and telecommunications. Furthermore, seemingly random changes in financial markets have motivated the extensive use of stochastic processes in finance.

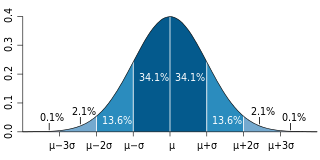

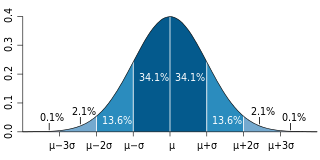

In probability theory, there exist several different notions of convergence of random variables. The convergence of sequences of random variables to some limit random variable is an important concept in probability theory, and its applications to statistics and stochastic processes. The same concepts are known in more general mathematics as stochastic convergence and they formalize the idea that a sequence of essentially random or unpredictable events can sometimes be expected to settle down into a behavior that is essentially unchanging when items far enough into the sequence are studied. The different possible notions of convergence relate to how such a behavior can be characterized: two readily understood behaviors are that the sequence eventually takes a constant value, and that values in the sequence continue to change but can be described by an unchanging probability distribution.

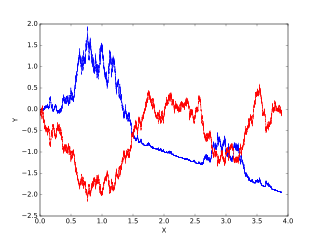

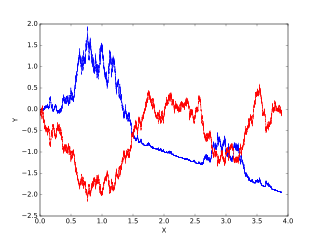

In mathematics, the Wiener process is a real-valued continuous-time stochastic process named in honor of American mathematician Norbert Wiener for his investigations on the mathematical properties of the one-dimensional Brownian motion. It is often also called Brownian motion due to its historical connection with the physical process of the same name originally observed by Scottish botanist Robert Brown. It is one of the best known Lévy processes and occurs frequently in pure and applied mathematics, economics, quantitative finance, evolutionary biology, and physics.

In probability theory, a martingale is a sequence of random variables for which, at a particular time, the conditional expectation of the next value in the sequence is equal to the present value, regardless of all prior values.

Probability is a measure of the likeliness that an event will occur. Probability is used to quantify an attitude of mind towards some proposition whose truth is not certain. The proposition of interest is usually of the form "A specific event will occur." The attitude of mind is of the form "How certain is it that the event will occur?" The certainty that is adopted can be described in terms of a numerical measure, and this number, between 0 and 1 is called the probability. Probability theory is used extensively in statistics, mathematics, science and philosophy to draw conclusions about the likelihood of potential events and the underlying mechanics of complex systems.

A stochastic differential equation (SDE) is a differential equation in which one or more of the terms is a stochastic process, resulting in a solution which is also a stochastic process. SDEs have many applications throughout pure mathematics and are used to model various behaviours of stochastic models such as stock prices, random growth models or physical systems that are subjected to thermal fluctuations.

Itô calculus, named after Kiyosi Itô, extends the methods of calculus to stochastic processes such as Brownian motion. It has important applications in mathematical finance and stochastic differential equations.

Joseph Leo Doob was an American mathematician, specializing in analysis and probability theory.

In probability theory, an empirical process is a stochastic process that describes the proportion of objects in a system in a given state. For a process in a discrete state space a population continuous time Markov chain or Markov population model is a process which counts the number of objects in a given state . In mean field theory, limit theorems are considered and generalise the central limit theorem for empirical measures. Applications of the theory of empirical processes arise in non-parametric statistics.

In probability theory, the martingale representation theorem states that a random variable that is measurable with respect to the filtration generated by a Brownian motion can be written in terms of an Itô integral with respect to this Brownian motion.

In mathematics, the theory of optimal stopping or early stopping is concerned with the problem of choosing a time to take a particular action, in order to maximise an expected reward or minimise an expected cost. Optimal stopping problems can be found in areas of statistics, economics, and mathematical finance. A key example of an optimal stopping problem is the secretary problem. Optimal stopping problems can often be written in the form of a Bellman equation, and are therefore often solved using dynamic programming.

In mathematics, Doob's martingale inequality, also known as Kolmogorov’s submartingale inequality is a result in the study of stochastic processes. It gives a bound on the probability that a submartingale exceeds any given value over a given interval of time. As the name suggests, the result is usually given in the case that the process is a martingale, but the result is also valid for submartingales.

In probability theory, a real valued stochastic process X is called a semimartingale if it can be decomposed as the sum of a local martingale and a càdlàg adapted finite-variation process. Semimartingales are "good integrators", forming the largest class of processes with respect to which the Itô integral and the Stratonovich integral can be defined.

In mathematics – specifically, in the theory of stochastic processes – Doob's martingale convergence theorems are a collection of results on the limits of supermartingales, named after the American mathematician Joseph L. Doob. Informally, the martingale convergence theorem typically refers to the result that any supermartingale satisfying a certain boundedness condition must converge. One may think of supermartingales as the random variable analogues of non-increasing sequences; from this perspective, the martingale convergence theorem is a random variable analogue of the monotone convergence theorem, which states that any bounded monotone sequence converges. There are symmetric results for submartingales, which are analogous to non-decreasing sequences.

In the theory of stochastic processes in discrete time, a part of the mathematical theory of probability, the Doob decomposition theorem gives a unique decomposition of every adapted and integrable stochastic process as the sum of a martingale and a predictable process starting at zero. The theorem was proved by and is named for Joseph L. Doob.

James Laurie Snell was an American mathematician and educator.