In computational mathematics, an iterative method is a mathematical procedure that uses an initial value to generate a sequence of improving approximate solutions for a class of problems, in which the n-th approximation is derived from the previous ones.

In economics, utility is a measure of the satisfaction that a certain person has from a certain state of the world. Over time, the term has been used in at least two different meanings.

In abstract algebra, a splitting field of a polynomial with coefficients in a field is the smallest field extension of that field over which the polynomial splits, i.e., decomposes into linear factors.

In mathematics, a reciprocity law is a generalization of the law of quadratic reciprocity to arbitrary monic irreducible polynomials with integer coefficients. Recall that first reciprocity law, quadratic reciprocity, determines when an irreducible polynomial splits into linear terms when reduced mod . That is, it determines for which prime numbers the relation

In economics, a complementary good is a good whose appeal increases with the popularity of its complement. Technically, it displays a negative cross elasticity of demand and that demand for it increases when the price of another good decreases. If is a complement to , an increase in the price of will result in a negative movement along the demand curve of and cause the demand curve for to shift inward; less of each good will be demanded. Conversely, a decrease in the price of will result in a positive movement along the demand curve of and cause the demand curve of to shift outward; more of each good will be demanded. This is in contrast to a substitute good, whose demand decreases when its substitute's price decreases.

In numerical analysis, the order of convergence and the rate of convergence of a convergent sequence are quantities that represent how quickly the sequence approaches its limit. A sequence that converges to is said to have order of convergence and rate of convergence if

In game theory, cheap talk is communication between players that does not directly affect the payoffs of the game. Providing and receiving information is free. This is in contrast to signalling, in which sending certain messages may be costly for the sender depending on the state of the world.

In quantum physics, the spin–orbit interaction is a relativistic interaction of a particle's spin with its motion inside a potential. A key example of this phenomenon is the spin–orbit interaction leading to shifts in an electron's atomic energy levels, due to electromagnetic interaction between the electron's magnetic dipole, its orbital motion, and the electrostatic field of the positively charged nucleus. This phenomenon is detectable as a splitting of spectral lines, which can be thought of as a Zeeman effect product of two relativistic effects: the apparent magnetic field seen from the electron perspective and the magnetic moment of the electron associated with its intrinsic spin. A similar effect, due to the relationship between angular momentum and the strong nuclear force, occurs for protons and neutrons moving inside the nucleus, leading to a shift in their energy levels in the nucleus shell model. In the field of spintronics, spin–orbit effects for electrons in semiconductors and other materials are explored for technological applications. The spin–orbit interaction is at the origin of magnetocrystalline anisotropy and the spin Hall effect.

The Marshall–Lerner condition is satisfied if the absolute sum of a country's export and import demand elasticities is greater than one. If it is satisfied, then if a country begins with a zero trade deficit then when the country's currency depreciates, its balance of trade will improve. The country's imports become more expensive and exports become cheaper due to the change in relative prices, and the Marshall-Lerner condition implies that the indirect effect on the quantity of trade will exceed the direct effect of the country having to pay a higher price for its imports and receive a lower price for its exports.

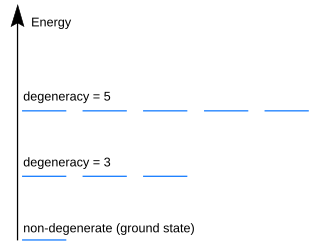

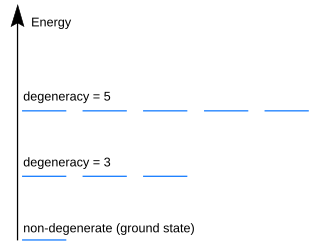

In quantum mechanics, an energy level is degenerate if it corresponds to two or more different measurable states of a quantum system. Conversely, two or more different states of a quantum mechanical system are said to be degenerate if they give the same value of energy upon measurement. The number of different states corresponding to a particular energy level is known as the degree of degeneracy of the level. It is represented mathematically by the Hamiltonian for the system having more than one linearly independent eigenstate with the same energy eigenvalue. When this is the case, energy alone is not enough to characterize what state the system is in, and other quantum numbers are needed to characterize the exact state when distinction is desired. In classical mechanics, this can be understood in terms of different possible trajectories corresponding to the same energy.

A Lindahl tax is a form of taxation conceived by Erik Lindahl in which individuals pay for public goods according to their marginal benefits. In other words, they pay according to the amount of satisfaction or utility they derive from the consumption of an additional unit of the public good. Lindahl taxation is designed to maximize efficiency for each individual and provide the optimal level of a public good.

In probability theory, the Chinese restaurant process is a discrete-time stochastic process, analogous to seating customers at tables in a restaurant. Imagine a restaurant with an infinite number of circular tables, each with infinite capacity. Customer 1 sits at the first table. The next customer either sits at the same table as customer 1, or the next table. This continues, with each customer choosing to either sit at an occupied table with a probability proportional to the number of customers already there, or an unoccupied table. At time n, the n customers have been partitioned among m ≤ n tables. The results of this process are exchangeable, meaning the order in which the customers sit does not affect the probability of the final distribution. This property greatly simplifies a number of problems in population genetics, linguistic analysis, and image recognition.

Competitive equilibrium is a concept of economic equilibrium, introduced by Kenneth Arrow and Gérard Debreu in 1951, appropriate for the analysis of commodity markets with flexible prices and many traders, and serving as the benchmark of efficiency in economic analysis. It relies crucially on the assumption of a competitive environment where each trader decides upon a quantity that is so small compared to the total quantity traded in the market that their individual transactions have no influence on the prices. Competitive markets are an ideal standard by which other market structures are evaluated.

In economics and game theory, an all-pay auction is an auction in which every bidder must pay regardless of whether they win the prize, which is awarded to the highest bidder as in a conventional auction. As shown by Riley and Samuelson (1981), equilibrium bidding in an all pay auction with private information is revenue equivalent to bidding in a sealed high bid or open ascending price auction.

In numerical linear algebra, the alternating-direction implicit (ADI) method is an iterative method used to solve Sylvester matrix equations. It is a popular method for solving the large matrix equations that arise in systems theory and control, and can be formulated to construct solutions in a memory-efficient, factored form. It is also used to numerically solve parabolic and elliptic partial differential equations, and is a classic method used for modeling heat conduction and solving the diffusion equation in two or more dimensions. It is an example of an operator splitting method.

In macroeconomics, the cost of business cycles is the decrease in social welfare, if any, caused by business cycle fluctuations.

In the mathematical discipline of numerical linear algebra, a matrix splitting is an expression which represents a given matrix as a sum or difference of matrices. Many iterative methods depend upon the direct solution of matrix equations involving matrices more general than tridiagonal matrices. These matrix equations can often be solved directly and efficiently when written as a matrix splitting. The technique was devised by Richard S. Varga in 1960.

In linear algebra, a convergent matrix is a matrix that converges to the zero matrix under matrix exponentiation.

Uri Hezkia Gneezy is an Israeli-American behavioral economist, known for his work on incentives. He currently holds the Epstein/Atkinson Endowed Chair in Behavioral Economics at the University of California, San Diego's Rady School of Management. He is also a visiting research professor at the University of Amsterdam and NHH in Bergen.

The uncertainty effect, also known as direct risk aversion, is a phenomenon from economics and psychology which suggests that individuals may be prone to expressing such an extreme distaste for risk that they ascribe a lower value to a risky prospect than its worst possible realization.