Ballot Measure 47 was an initiative in the U.S. state of Oregon that passed in 1996, affecting the assessment of property taxes and instituting a double majority provision for tax legislation. Measure 50 was a revised version of the law, which also passed, after being referred to the voters by the 1997 state legislature.

The Oregon tax revolt is a political movement in Oregon which advocates for lower taxes. This movement is part of a larger anti-tax movement in the western United States which began with the enactment of Proposition 13 in California. The tax revolt, carried out in large part by a series of citizens' initiatives and referendums, has reshaped the debate about taxes and public services in Oregon.

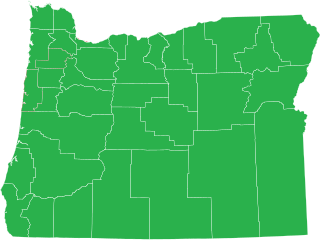

The Oregon Medical Marijuana Act, a law in the U.S. state of Oregon, was established by Oregon Ballot Measure 67 in 1998, passing with 54.6% support. It modified state law to allow the cultivation, possession, and use of marijuana by doctor recommendation for patients with certain medical conditions. The Act does not affect federal law, which still prohibits the cultivation and possession of marijuana.

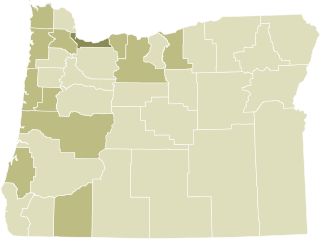

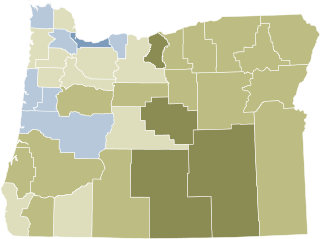

Oregon ballot measure 48 was one of two unsuccessful ballot measures sponsored by the Taxpayers Association of Oregon (TAO) on the November 7, 2006 general election ballot. Measure 48 was an initiated constitutional amendment ballot measure. Oregon statute currently limits state appropriations to 8% of projected personal income in Oregon. If Governor declares emergency, legislature may exceed current statutory appropriations limit by 60% vote of each house. This measure would have added a constitutional provision limiting any increase in state spending from one biennium to next biennium to the percentage increase in state population, plus inflation, over previous two years. Certain exceptions to limit, including spending of: federal, donated funds; proceeds from selling certain bonds, real property; money to fund emergency funds; money to fund tax, "kicker," other refunds were included in the provisions of the measure. It also would have provided that spending limit may be exceeded by amount approved by two-thirds of each house of legislature and approved by majority of voters voting in general election.

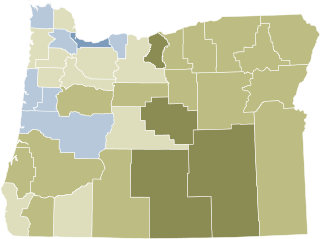

On November 4, 2008, the U.S. state of Oregon held statewide general elections for three statewide offices, both houses of the Oregon Legislative Assembly, and twelve state ballot measures. The primary elections were held on May 20, 2008. Both elections also included national races for President of the US, US Senator, and US House Representatives. Numerous local jurisdictions — cities, counties, and regional government entities — held elections for various local offices and ballot measures on these days as well.

The 75th Oregon Legislative Assembly convened beginning on January 12, 2009, for its biennial regular session. All of the 60 seats in the House of Representatives and half of the 30 seats in the State Senate were up for election in 2008; the general election for those seats took place on November 4.

Oregon Ballot Measure 64 was an initiated state statute ballot measure on the November 4, 2008 general election ballot in Oregon.

Oregon Ballot Measure 58 was an initiated state statute ballot measure sponsored by Bill Sizemore that appeared on the November 4, 2008 general election ballot in Oregon. It was rejected by voters.

Oregon Ballot Measure 59 was an initiated state statute ballot measure sponsored by Bill Sizemore that appeared on the November 4, 2008 general election ballot in Oregon, United States. If it had passed, Oregon would have join Alabama, Iowa, and Louisiana as the only states to allow federal income taxes to be fully deducted on state income tax returns.

Oregon Ballot Measure 60 was an initiated state statute ballot measure filed by Bill Sizemore and R. Russell Walker. Sizemore referred to it the "Kids First Act." The measure appeared on the November 4, 2008 general election ballot in Oregon.

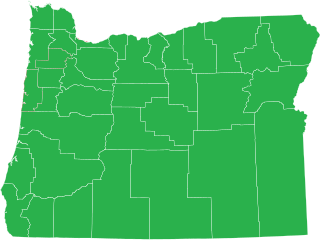

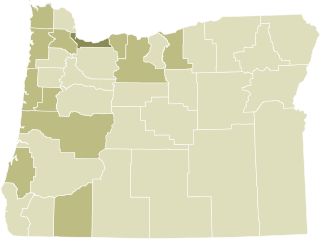

Oregon Ballot Measure 56 or House Joint Resolution 15 is a legislatively referred constitutional amendment that enacted law which provides that property tax elections decided at May and November elections will be decided by a majority of voters who are voting in the relevant election. It repealed the double majority requirement passed by the voters in the 1990s via Measures 47 and 50, which requires that, for non-general elections, all bond measures can pass only when a majority of registered voters turn out.

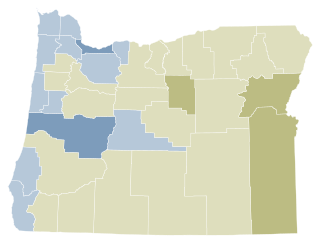

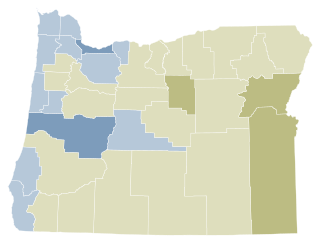

Oregon Ballot Measure 62 (2008) appeared on the November 4, 2008 general election ballot in Oregon. It was an initiated constitutional amendment dealing with the issue of where a percentage of profit from the Oregon State Lottery should go. The initiative, if it had passed, would have required that 15% of net lottery proceeds be deposited in a public safety fund. 50% of that fund would have been distributed to counties to fund grants for childhood programs, district attorney operations, and sheriff's investigations. The other 50% of the fund would have gone to Oregon State Police criminal investigations and forensic operations. It is expected that most of that money would have been diverted from schools. It was rejected with around 60% of the votes statewide; every county except for Josephine saw majority rejection.

The November 6, 2007 special Election, was an off-year election in which no members of the Congress, statewide offices, or members of the Oregon Legislative Assembly were scheduled for election. However, two statewide measures were referred by the legislature to the 2007 November Special Election ballot. While there were only two issues on the ballot, they touched on important enough issues that they attracted one hundred seventy-five arguments in total, both in favor of, and against them in the voter's pamphlet.

Oregon ballot measure 44 was an initiated state statute ballot measure on the November 7, 2006 general election ballot. The Measure modified the eligibility requirements for Oregon residents to participate in the Oregon Prescription Drug Program. The program intends to make prescription drugs available to participants at the lowest possible cost through negotiated price discounts. It was passed overwhelmingly by voters, garnering 78% of the vote.

The U.S. state of Oregon has various policies restricting the production, sale, and use of different substances. In 2006, Oregon's per capita drug use exceeded the national average. The most used substances were marijuana, methamphetamine and illicit painkillers and stimulants.

General elections were held in Oregon on November 2, 2010. Primary elections took place on May 18, 2010.

Oregon Ballot Measure 44 was brought to the November, 1996 general election in the U.S. state of Oregon by the initiative process. It passed with 55.9% of the vote. With strong backing from Governor John Kitzhaber, PeaceHealth, a hospital in Eugene, teamed with the Oregon Association of Hospital and Health Systems (OAHHS) to bring about the initiative. Measure 44 would raise tobacco taxes in the state. The primary purpose for raising tobacco taxes was to raise money to fund the Oregon Health Plan (OHP). Additionally some of the money from the tobacco tax would go towards programs to prevent tobacco use and educate people about the harmful effects of tobacco, primarily aimed at children. Measure 44 became highly politicized on both sides.

California state elections in 2018 were held on Tuesday, November 6, 2018, with the primary elections being held on June 5, 2018. Voters elected one member to the United States Senate, 53 members to the United States House of Representatives, all eight state constitutional offices, all four members to the Board of Equalization, 20 members to the California State Senate, and all 80 members to the California State Assembly, among other elected offices.

Oregon Ballot Measure 111, the Right to Healthcare Amendment, is an amendment to the Constitution of Oregon that voters passed as part of the 2022 Oregon elections. The amendment states that "It is the obligation of the state to ensure that every resident of Oregon has access to cost-effective, clinically appropriate and affordable health care as a fundamental right." This measure makes Oregon the first state with a constitutional right to healthcare.