Description of the Measure

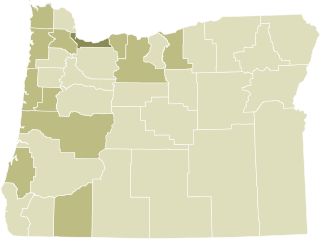

Ballot Measure 48 would have restricted the amount of money the State could spend in its annual budget. It proposed to limit state spending by amending the state's constitution to provide that,unless approved by a 2/3 vote of both the Oregon House and Senate and a subsequent approval by a majority of the voters,spending for state services in a two-year period cannot exceed the amount spent in the previous two-year period plus the combined rate of the increase of the state's population and inflation in that same,previous,two-year period. [2]

If passed,the amendment would apply to spending of aggregate revenues collected from a variety of sources including but not limited to:income tax,lottery receipts,tuition,professional licensing and other taxes and fees. The measure would not have applied to revenues from the following sources:federal funds,voluntary donations to state agencies,proceeds from the sale of bonds specifically approved by the voters and proceeds from the sale of real property at real market value to non-government entities. [2]

The measure would not apply to money spent for the following purposes:tax and "kicker" refunds or money placed in an emergency fund or a "rainy day" reserve fund. (Money placed into an emergency or "rainy day" fund would not be available for state spending in excess of the spending limit without a 2/3 vote of the House and Senate and approval by the voters.) [2]

The Legislative Fiscal Office estimated that the measure's effect in the 2007 biennium would restrict spending of approximately $2.2 billion out of approximately $35.6 billion in revenues estimated to be subject to the limit. [2]

If it had been passed and put into effect,the Legislature could refund the restricted funds to taxpayers,place them in the funds noted above,leave them in the treasury and/or,with a 2/3 vote of each house of the legislature refer to voters a plan to spend them on state services. [2]

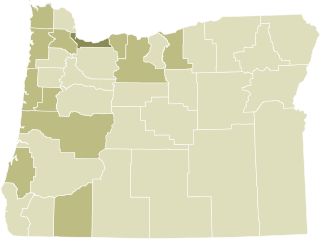

Measure 28 was a ballot measure, referred by the legislature of the U.S. state of Oregon in 2003. It would have created a temporary one-percent increase in Oregon's income tax. The tax was proposed as a way to overcome deficits to the state budget. The measure was defeated in the January 28, 2003 special election with 575,846 votes in favor, 676,312 votes against.

The Oregon tax revolt is a political movement in Oregon which advocates for lower taxes. This movement is part of a larger anti-tax movement in the western United States which began with the enactment of Proposition 13 in California. The tax revolt, carried out in large part by a series of citizens' initiatives and referendums, has reshaped the debate about taxes and public services in Oregon.

In California, a ballot proposition is a referendum or an initiative measure that is submitted to the electorate for a direct decision or direct vote. If passed, it can alter one or more of the articles of the Constitution of California, one or more of the 29 California Codes, or another law in the California Statutes by clarifying current or adding statute(s) or removing current statute(s).

The Taxpayer Bill of Rights is a concept advocated by conservative and free market libertarian groups, primarily in the United States, as a way of limiting the growth of government. It is not a charter of rights but a provision requiring that increases in overall tax revenue be tied to inflation and population increases unless larger increases are approved by referendum.

Proposition 2½ is a Massachusetts statute that limits property tax assessments and, secondarily, automobile excise tax levies by Massachusetts municipalities. The name of the initiative refers to the 2.5% ceiling on total property taxes annually as well as the 2.5% limit on property tax increases. It was passed by ballot measure, specifically called an initiative petition within Massachusetts state law for any form of referendum voting, in 1980 and went into effect in 1982. The effort to enact the proposition was led by the anti-tax group Citizens for Limited Taxation. It is similar to other "tax revolt" measures passed around the same time in other parts of the United States. This particular proposition followed the movements of states such as California.

Proposition 218 is an adopted initiative constitutional amendment which revolutionized local and regional government finance and taxation in California. Named the "Right to Vote on Taxes Act," it was sponsored by the Howard Jarvis Taxpayers Association as a constitutional follow-up to the landmark property tax reduction initiative constitutional amendment, Proposition 13, approved in June 1978. Proposition 218 was approved and adopted by California voters during the November 5, 1996, statewide general election.

The 2007 Texas constitutional amendment election took place 6 November 2007.

The Oregon tax rebate, commonly referred to as the kicker, is a rebate calculated for both individual and corporate taxpayers in the U.S. state of Oregon when a revenue surplus exists. The Oregon Constitution mandates that the rebate be issued when the calculated revenue for a given biennium exceeds the forecast revenue by at least two percent. The law was first enacted by ballot measure in 1980, and was entered into the Oregon Constitution with the enactment of Ballot Measure 86 in 2000.

The 75th Oregon Legislative Assembly convened beginning on January 12, 2009, for its biennial regular session. All of the 60 seats in the House of Representatives and half of the 30 seats in the State Senate were up for election in 2008; the general election for those seats took place on November 4.

Initiative 126 or the Savings Account for Education Initiative appeared on the ballot as Amendment 59. The measure would have created a savings account in the state education fund funded by 10 percent of the monies deposited into the fund, including revenue that would otherwise be rebated under the Taxpayer Bill of Rights rules.

Oregon Ballot Measure 59 was an initiated state statute ballot measure sponsored by Bill Sizemore that appeared on the November 4, 2008 general election ballot in Oregon, United States. If it had passed, Oregon would have join Alabama, Iowa, and Louisiana as the only states to allow federal income taxes to be fully deducted on state income tax returns.

Oregon ballot measure 41 was one of two unsuccessful ballot measures sponsored by the Taxpayers Association of Oregon (TAO) on the November 7, 2006 general election ballot. If passed it would have allowed a state income tax deduction equal to Federal exemptions deduction to substitute for state exemption credit on a person's state income tax filing.

Oregon ballot measures 46 and 47 were two ballot measures presented as a single package to voters; 46 would have amended the Constitution to allow limitations on campaign financing ; and 47 detailed specific limitations. While Measure 47 passed, 46 did not, and the Secretary of State and Attorney General now refuse to enforce Measure 47 despite not having made constitutional challenges in court during cases filed against them to compel enforcement.

General elections were held in Oregon on November 2, 2010. Primary elections took place on May 18, 2010.

2015 Michigan Proposal 1, also known as the Michigan Sales Tax Increase for Transportation Amendment, was a referendum held on May 5, 2015, concerning a legislatively-referred ballot measure. The measure's approval would have caused one constitutional amendment and 10 statutes to go into effect. It is estimated that Proposal 1 would raise state revenues from sales and use taxes by $1.427 billion, fuel taxes by $463 million, truck registration fees by $50 million, and vehicle registration fees by $10.1 million in the first year. If approved, the proposal was estimated by the Associated Press to result in an average tax increase of $545 per household in 2016.

California state elections in 2018 were held on Tuesday, November 6, 2018, with the primary elections being held on June 5, 2018. Voters elected one member to the United States Senate, 53 members to the United States House of Representatives, all eight state constitutional offices, all four members to the Board of Equalization, 20 members to the California State Senate, and all 80 members to the California State Assembly, among other elected offices.

California Proposition 69 was a legislatively referred constitutional amendment that appeared on ballots in California in the June primary election in 2018. This measure put the revenue from the Road Repair and Accountability Act, which increased fuel taxes, in a "lockbox" so that it can only be used for transportation-related purposes. It also exempts said gas tax revenue from the previously existing appropriations mandate and expenditures limit. This state constitution amendment ensures that revenues from SB1 Gas Taxes established by the Road Repair and Accountability Act of 2017 can only be used for transportation-related purposes.

Proposition 13 was a failed California ballot proposition on the March 3, 2020, ballot that would have authorized the issuance of $15 billion in bonds to finance capital improvements for public and charter schools statewide. The proposition would have also raised the borrowing limit for some school districts and eliminated school impact fees for multifamily housing near transit stations.

California Proposition 19 (2020), also referred to as Assembly Constitutional Amendment No. 11, is an amendment of the Constitution of California that was narrowly approved by voters in the general election on November 3, 2020, with just over 51% of the vote. The legislation increases the property tax burden on owners of inherited property to provide expanded property tax benefits to homeowners ages 55 years and older, disabled homeowners, and victims of natural disasters, and fund wildfire response. According to the California Legislative Analyst, Proposition 19 is a large net tax increase "of hundreds of millions of dollars per year."