Emissions trading is a market-based approach to controlling pollution by providing economic incentives for reducing the emissions of pollutants. The concept is also known as cap and trade (CAT) or emissions trading scheme (ETS). One prominent example is carbon emission trading for CO2 and other greenhouse gases which is a tool for climate change mitigation. Other schemes include sulfur dioxide and other pollutants.

Environmental economics is a sub-field of economics concerned with environmental issues. It has become a widely studied subject due to growing environmental concerns in the twenty-first century. Environmental economics "undertakes theoretical or empirical studies of the economic effects of national or local environmental policies around the world. ... Particular issues include the costs and benefits of alternative environmental policies to deal with air pollution, water quality, toxic substances, solid waste, and global warming."

A market economy is an economic system in which the decisions regarding investment, production and distribution to the consumers are guided by the price signals created by the forces of supply and demand. The major characteristic of a market economy is the existence of factor markets that play a dominant role in the allocation of capital and the factors of production.

In economics, an externality or external cost is an indirect cost or benefit to an uninvolved third party that arises as an effect of another party's activity. Externalities can be considered as unpriced goods involved in either consumer or producer market transactions. Air pollution from motor vehicles is one example. The cost of air pollution to society is not paid by either the producers or users of motorized transport to the rest of society. Water pollution from mills and factories is another example. All consumers are made worse off by pollution but are not compensated by the market for this damage. A positive externality is when an individual's consumption in a market increases the well-being of others, but the individual does not charge the third party for the benefit. The third party is essentially getting a free product. An example of this might be the apartment above a bakery receiving the benefit of enjoyment from smelling fresh pastries every morning. The people who live in the apartment do not compensate the bakery for this benefit.

A mixed economy is variously defined as an economic system blending elements of a market economy with elements of a planned economy, markets with state interventionism, or private enterprise with public enterprise. Common to all mixed economies is a combination of free-market principles and principles of socialism. While there is no single definition of a mixed economy, one definition is about a mixture of markets with state interventionism, referring specifically to a capitalist market economy with strong regulatory oversight and extensive interventions into markets. Another is that of active collaboration of capitalist and socialist visions. Yet another definition is apolitical in nature, strictly referring to an economy containing a mixture of private enterprise with public enterprise. Alternatively, a mixed economy can refer to a reformist transitionary phase to a socialist economy that allows a substantial role for private enterprise and contracting within a dominant economic framework of public ownership. This can extend to a Soviet-type planned economy that has been reformed to incorporate a greater role for markets in the allocation of factors of production.

A subsidy or government incentive is a type of government expenditure for individuals and households, as well as businesses with the aim of stabilizing the economy. It ensures that individuals and households are viable by having access to essential goods and services while giving businesses the opportunity to stay afloat and/or competitive. Subsidies not only promote long term economic stability but also help governments to respond to economic shocks during a recession or in response to unforeseen shocks, such as the COVID-19 pandemic.

An environmental tax, ecotax, or green tax is a tax levied on activities which are considered to be harmful to the environment and is intended to promote environmentally friendly activities via economic incentives. A notable example is carbon tax. Such a policy can complement or avert the need for regulatory approaches. Often, an ecotax policy proposal may attempt to maintain overall tax revenue by proportionately reducing other taxes ; such proposals are known as a green tax shift towards ecological taxation. Ecotaxes address the failure of free markets to consider environmental impacts.

Race to the bottom is a socio-economic phrase to describe either government deregulation of the business environment or reduction in corporate tax rates, in order to attract or retain economic activity in their jurisdictions. While this phenomenon can happen between countries as a result of globalization and free trade, it also can occur within individual countries between their sub-jurisdictions. It may occur when competition increases between geographic areas over a particular sector of trade and production. The effect and intent of these actions is to lower labor rates, cost of business, or other factors over which governments can exert control.

A Pigouvian tax is a tax on any market activity that generates negative externalities. The tax is normally set by the government to correct an undesirable or inefficient market outcome and does so by being set equal to the external marginal cost of the negative externalities. In the presence of negative externalities, social cost includes private cost and external cost caused by negative externalities. This means the social cost of a market activity is not covered by the private cost of the activity. In such a case, the market outcome is not efficient and may lead to over-consumption of the product. Often-cited examples of negative externalities are environmental pollution and increased public healthcare costs associated with tobacco and sugary drink consumption.

Social cost in neoclassical economics is the sum of the private costs resulting from a transaction and the costs imposed on the consumers as a consequence of being exposed to the transaction for which they are not compensated or charged. In other words, it is the sum of private and external costs. This might be applied to any number of economic problems: for example, social cost of carbon has been explored to better understand the costs of carbon emissions for proposed economic solutions such as a carbon tax.

Democratic capitalism, also referred to as market democracy, is a political and economic system. It integrates resource allocation by marginal productivity, with policies of resource allocation by social entitlement. The policies which characterise the system are enacted by democratic governments.

Eco-capitalism, also known as environmental capitalism or (sometimes) green capitalism, is the view that capital exists in nature as "natural capital" on which all wealth depends. Therefore, governments should use market-based policy-instruments to resolve environmental problems.

Government failure, in the context of public economics, is an economic inefficiency caused by a government intervention, if the inefficiency would not exist in a true free market. The costs of the government intervention are greater than the benefits provided. It can be viewed in contrast to a market failure, which is an economic inefficiency that results from the free market itself, and can potentially be corrected through government regulation. However, Government failure often arises from an attempt to solve market failure. The idea of government failure is associated with the policy argument that, even if particular markets may not meet the standard conditions of perfect competition required to ensure social optimality, government intervention may make matters worse rather than better.

The Anglo-Saxon model is a regulated market-based economic model that emerged in the 1970s based on the Chicago school of economics, spearheaded in the 1980s in the United States by the economics of then President Ronald Reagan, and reinforced in the United Kingdom by then Prime Minister Margaret Thatcher. However, its origins are said to date to the 18th century in the United Kingdom and the ideas of the classical economist Adam Smith.

Economic progressivism or fiscalprogressivism is a political and economic philosophy incorporating the socioeconomic principles of social democrats and political progressives. These views are often rooted in the concept of social justice and have the goal of improving the human condition through government regulation, social protections and the maintenance of public goods. It is not to be confused with the more general idea of progress in relation to economic growth.

A green-collar worker is a worker who is employed in an environmental sector of the economy. Environmental green-collar workers satisfy the demand for green development. Generally, they implement environmentally conscious design, policy, and technology to improve conservation and sustainability. Formal environmental regulations as well as informal social expectations are pushing many firms to seek professionals with expertise with environmental, energy efficiency, and clean renewable energy issues. They often seek to make their output more sustainable, and thus more favorable to public opinion, governmental regulation, and the Earth's ecology.

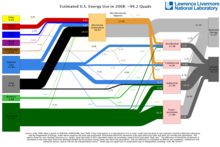

Energy subsidies are measures that keep prices for customers below market levels, or for suppliers above market levels, or reduce costs for customers and suppliers. Energy subsidies may be direct cash transfers to suppliers, customers, or related bodies, as well as indirect support mechanisms, such as tax exemptions and rebates, price controls, trade restrictions, and limits on market access.

In economics, an environmentally honest market system refers to a market which reflects ecological and environmental health costs such as resource depletion and pollution.

Green industrial policy (GIP) is strategic government policy that attempts to accelerate the development and growth of green industries to transition towards a low-carbon economy. Green industrial policy is necessary because green industries such as renewable energy and low-carbon public transportation infrastructure face high costs and many risks in terms of the market economy. Therefore, they need support from the public sector in the form of industrial policy until they become commercially viable. Natural scientists warn that immediate action must occur to lower greenhouse gas emissions and mitigate the effects of climate change. Social scientists argue that the mitigation of climate change requires state intervention and governance reform. Thus, governments use GIP to address the economic, political, and environmental issues of climate change. GIP is conducive to sustainable economic, institutional, and technological transformation. It goes beyond the free market economic structure to address market failures and commitment problems that hinder sustainable investment. Effective GIP builds political support for carbon regulation, which is necessary to transition towards a low-carbon economy. Several governments use different types of GIP that lead to various outcomes. The Green Industry plays a pivotal role in creating a sustainable and environmentally responsible future; By prioritizing resource efficiency, renewable energy, and eco-friendly practices, this industry significantly benefits society and the planet at large.

Green economy policies in Canada are policies that contribute to transitioning the Canadian economy to a more environmentally sustainable one. The green economy can be defined as an economy, "that results in improved human well-being and social equity, while significantly reducing environmental risks and ecological scarcities." Aspects of a green economy would include stable growth in income and employment that is driven by private and public investment into policies and actions that reduce carbon emissions, pollution and prevent the loss of biodiversity.