| |

| Currency | Euro (EUR, €) |

|---|---|

| Calendar year | |

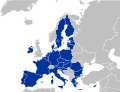

Trade organisations | EU, WTO and OECD |

Country group | |

| Statistics | |

| Population | |

| GDP | |

| GDP rank | |

GDP growth | |

GDP per capita | |

GDP per capita rank | |

GDP by sector |

|

| 2.6% (2025f) [6] | |

Population below poverty line | |

| |

Labour force | |

Labour force by occupation |

|

| Unemployment | |

Average gross salary | €6,191 / $7,006 monthly (2024) [16] [17] |

| €4,201 / $4,756 monthly (2024) [18] [19] | |

Main industries | banking and financial services, construction, real estate services, iron, metals, and steel, information technology, telecommunications, cargo transportation and logistics, chemicals, engineering, tires, glass, aluminum, tourism, biotechnology |

| External | |

| Exports | $100 billion (2022 est.) [7] |

Export goods | machinery and equipment, steel products, chemicals, rubber products, glass |

Main export partners |

|

| Imports | $50 billion (2022 est.) [7] |

Import goods | commercial aircraft, minerals, chemicals, metals, foodstuffs, luxury consumer goods |

Main import partners |

|

FDI stock | $50 billion (31 December 2021 est.) [7] Abroad: NA [7] |

| $3.112 billion (2017 est.) | |

Gross external debt | $5 trillion (31 March 2022 est.) [7] |

| Public finances | |

| $1.5 billion (31 December 2021 est.) [7] | |

| Revenues | 30% of GDP (2019) [20] |

| Expenses | 25% of GDP (2019) [20] |

| Economic aid |

|

All values, unless otherwise stated, are in US dollars. | |

Luxembourg has a developed economy largely dependent on the banking, steel, and industrial sectors. Citizens of Luxembourg enjoy the highest per capita gross domestic product in the world, according to an IMF estimate in 2022. [26] Among OECD nations, Luxembourg has a highly efficient and strong social security system; social welfare expenditure stood at roughly 21.9% of GDP. [3] [4] [27]

Contents

- History

- Sectors

- The financial center

- Steel

- Telecommunications

- Tourism

- Agriculture

- Data

- Energy

- Spaceflight and space resource extraction

- Transportation

- See also

- References

- Further reading

- Notes

- External links

Prior to the mid-19th century, Luxembourg was primarily rural and mostly isolated from commerce with neighboring economies. [28] In the late 19th century, Luxembourg's dominant sector was steel industry. [28] Over time, the main economic sector became finance. [29] Due to its reputation for secrecy, it has become an attractive location for individuals and businesses to hold assets for tax avoidance and tax evasion purposes. [30] [31]