A keiretsu is a set of companies with interlocking business relationships and shareholdings that dominated the Japanese economy in the second half of the 20th century. In the legal sense, it is a type of business group that is in a loosely organized alliance within Japan's business community. It rose up to replace the zaibatsu system that was dissolved in the occupation of Japan following the Second World War. Though their influence has shrunk since the late 20th century, they continue to be important forces in Japan's economy in the early 21st century.

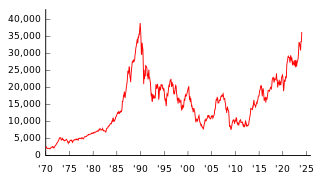

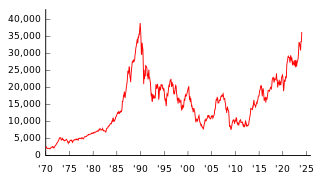

The Nikkei 225, or the Nikkei Stock Average, more commonly called the Nikkei or the Nikkei index, is a stock market index for the Tokyo Stock Exchange (TSE). It is a price-weighted index, operating in the Japanese Yen (JP¥), and its components are reviewed twice a year. The Nikkei 225 measures the performance of 225 highly capitalised and liquid publicly owned companies in Japan from a wide array of industry sectors. Since 2017, the index is calculated every five seconds. It was originally launched by the Tokyo Stock Exchange in 1950, and was taken over by the Nihon Keizai Shimbun newspaper in 1970, when the Tokyo Exchange switched to the Tokyo Stock Price Index (TOPIX), which is weighed by market capitalisation rather than stock prices.

Mitsui Group is a Japanese corporate group and keiretsu that traces its roots to the zaibatsu groups that were dissolved after World War II. Unlike the zaibatsu of the pre-war period, there is no controlling company with regulatory power. Instead, the companies in the group hold shares in each other, but they are limited to exchanging information and coordinating plans through regular meetings.

Itochu Corporation is a Japanese corporation based in Umeda, Kita-ku, Osaka and Aoyama, Minato, Tokyo.

Chūō-ku is one of 24 wards of Osaka, Japan. It has an area of 8.88 km2, and a population of 60,085. It houses Osaka's financial district, as well as the Osaka Prefecture offices and principal shopping and tourist areas.

Mitsubishi Corporation is Japan's largest trading company and a member of the Mitsubishi keiretsu. As of 2022, Mitsubishi Corporation employs over 80,000 people and has ten business segments, including energy, industrial finance, banking, machinery, chemicals, and food.

Sojitz Corporation is a sogo shosha based in Tokyo, Japan. It is engaged in a wide range of businesses globally, including buying, selling, importing, and exporting goods, manufacturing and selling products, providing services, and planning and coordinating projects, in Japan and overseas. Sojitz also invests in various sectors and conducts financing activities. The broad range of sectors in which Sojitz operates includes automobiles, energy, mineral resources, chemicals, foodstuff resources, agricultural and forestry resources, consumer goods, and industrial parks.

Sumitomo Mitsui Financial Group, Inc. (株式会社三井住友フィナンシャルグループ), initialed as SMFG until 2018 and SMBC Group since, is a major Japanese multinational financial services group and holding company. It is the parent of Sumitomo Mitsui Banking Corporation (SMBC), SMBC Trust Bank, and SMBC Nikko Securities. SMBC originates from the 2001 merger of Sumitomo Bank with the Sakura Bank, itself a successor to the Mitsui Bank, and the group holding entity was created in December 2002 after which SMBC became its wholly-owned subsidiary.

The Sumitomo Group is a Japanese corporate group and keiretsu that traces its roots to the zaibatsu groups that were dissolved after World War II. Unlike the zaibatsu of the pre-war period, there is no controlling company with regulatory power. Instead, the companies in the group hold shares in each other, but they are limited to exchanging information and coordinating plans through regular meetings.

The Sumitomo Bank, Limited was a major Japanese bank, founded 1895 in Osaka and a central component of the Sumitomo Group. For much of the 20th century it was one of the largest Japanese banks, together with Dai-Ichi Bank, Mitsubishi Bank, Mitsui Bank, and Yasuda / Fuji Bank. In 1948, it was renamed Osaka Bank, but reverted to Sumitomo Bank in 1952.

Mitsubishi UFJ Financial Group, Inc. is a Japanese bank holding and financial services company headquartered in Chiyoda, Tokyo, Japan. MUFG was created in 2005 by merger between Mitsubishi Tokyo Financial Group and UFJ Holdings. These two groups in turn brought together multiple predecessor banks including Mitsubishi Bank, Yokohama Specie Bank, Sanwa Bank, and Tokai Bank.

Toray Industries, Inc. is a multinational corporation headquartered in Japan that specializes in industrial products centered on technologies in organic synthetic chemistry, polymer chemistry, and biochemistry.

Japan Transport Engineering Company (J-TREC) is a manufacturer of heavy rail cars in Japan, formerly known as Tokyu Car Corporation. The company is based in Kanazawa-ku, Yokohama, and a member of East Japan Railway Company group. J-TREC manufactures rail vehicles not only for JR East and Tokyu Corporation but for other Japanese operators, including various Japan Railways Group companies and international operators as well.

Sumitomo Realty & Development Co., Ltd. is a Japanese real estate development company headquartered in Shinjuku, Tokyo. It is a member of the Sumitomo Group.

Sogo shosha are Japanese wholesale companies that trade in a wide range of products and materials. In addition to acting as intermediaries, sōgō shōsha also engage in logistics, plant development and other services, as well as international resource exploration. Unlike trading companies in other countries, which are generally specialized in certain types of products, sōgō shōsha have extremely diversified business lines, in which respect the business model is unique to Japan.

Sumitomo Heavy Industries, Ltd. (SHI) is an integrated manufacturer of industrial machinery, automatic weaponry, ships, bridges and steel structure, equipment for environmental protection, including recycling, power transmission equipment, plastic molding machines, laser processing systems, particle accelerators, material handling systems, cancer diagnostic and treatment equipment and others.

MinebeaMitsumi, Inc. is a Japanese multinational manufacturer of mechanical components and electronic devices. The company's headquarters are located in Higashi-Shinbashi, Minato, Tokyo, and its registered office is located in Miyota, Nagano.

SBI Holdings, sometimes referred to as Strategic Business Innovator Group, is a financial services company group based in Tokyo, Japan. The group's businesses and companies are held primarily at SBI Holdings.

Sumitomo Mitsui Trust Holdings, Inc., formerly Chuo Mitsui Trust Holdings, Inc., is a Japanese financial holding company headquartered in Chiyoda, Tokyo. It provides an assortment of financial products to retail and wholesale customers, with a focus on asset management, financial brokerage, and real estate services.

Mitsui Bank, Ltd. was a major Japanese bank from 1876 to 1990. The home bank of the Mitsui conglomerate, it was one of the largest Japanese banks for much of the 20th century, together with Dai-Ichi Bank, Mitsubishi Bank, Sumitomo Bank, and Yasuda / Fuji Bank. In 1943 it merged with Dai-Ichi Bank to form Teikoku Bank. In 1948, Dai-Ichi Bank was spun off again from Teikoku, which changed its name back to Mitsui Bank in 1954.