The Taxpayer Bill of Rights is a concept advocated by conservative and free market libertarian groups, primarily in the United States, as a way of limiting the growth of government. It is not a charter of rights but a provision requiring that increases in overall tax revenue be tied to inflation and population increases unless larger increases are approved by referendum.

Proposition 1A was a California ballot proposition on the November 2, 2004 ballot. The proposition passed with 9,411,198 (83.7%) votes in favor and 1,840,002 (16.3%) against.

Proposition 2½ is a Massachusetts statute that limits property tax assessments and, secondarily, automobile excise tax levies by Massachusetts municipalities. The name of the initiative refers to the 2.5% ceiling on total property taxes annually as well as the 2.5% limit on property tax increases. It was passed by ballot measure, specifically called an initiative petition within Massachusetts state law for any form of referendum voting, in 1980 and went into effect in 1982. The effort to enact the proposition was led by the anti-tax group Citizens for Limited Taxation. It is similar to other "tax revolt" measures passed around the same time in other parts of the United States. This particular proposition followed the movements of states such as California.

California Proposition 82 was a proposition on the ballot for California voters in the primary election of June 6, 2006. The proposition would have made a free, voluntary, half-day public preschool program available to all four-year-olds in California. The State would have imposed a new tax on high-income taxpayers to pay for the new program. It was proposed by movie producer Rob Reiner. On the ballot, it received 1,583,787 (39.1%) yes votes and 2,460,556 (60.9%) no votes, thereby not passing.

In 2021, the economy of the State of Colorado was 16th largest in the United States with a gross state product of $421 billion.Colorado's per capita personal income in 2019 was $61,157, putting Colorado 12th in the nation.

Colorado Amendment 50 was a citizen's initiative that amended the Colorado state constitution to:

Proposition 1D was a defeated California ballot proposition that appeared on the May 19, 2009 special election ballot. The measure was legislatively referred by the State Legislature. If approved, the proposition would have authorized a one-time reallocation of tobacco tax revenue to help balance the state budget.

Proposition 1E was a defeated California ballot proposition that appeared on the May 19, 2009 special election ballot. The measure was legislatively referred by the State Legislature. If passed Proposition 1E would have authorized a one-time reallocation of income tax revenue to help balance the state budget.

Proposition 29, the California Cancer Research Act, is a California ballot measure that was defeated by California voters at the statewide election on June 5, 2012.

Colorado Amendment 64 was a successful popular initiative ballot measure to amend the Constitution of the State of Colorado, outlining a statewide drug policy for cannabis. The measure passed on November 6, 2012, and along with a similar measure in Washington state, marked "an electoral first not only for America but for the world."

Proposition 56 is a California ballot proposition that passed on the November 8, 2016 ballot. It increased the cigarette tax by $2.00 per pack, effective April 1, 2017, with equivalent increases on other tobacco products and electronic cigarettes containing nicotine. The bulk of new revenue is earmarked for Medi-Cal.

The California state elections in 2020 were held on Tuesday, November 3, 2020. Unlike previous election cycles, the primary elections were held on Super Tuesday, March 3, 2020.

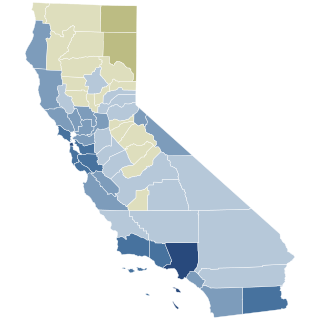

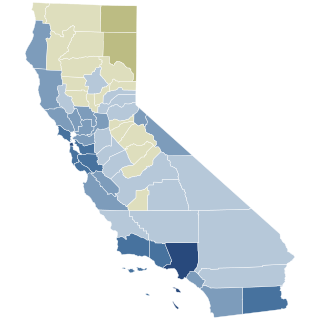

California Proposition 19 (2020), also referred to as Assembly Constitutional Amendment No. 11, is an amendment of the Constitution of California that was narrowly approved by voters in the general election on November 3, 2020, with just over 51% of the vote. The legislation increases the property tax burden on owners of inherited property to provide expanded property tax benefits to homeowners ages 55 years and older, disabled homeowners, and victims of natural disasters, and fund wildfire response. According to the California Legislative Analyst, Proposition 19 is a large net tax increase "of hundreds of millions of dollars per year."

Colorado Proposition EE was a legislative referendum that appeared on ballots in Colorado in the November 2020 elections. It was a proposal to increase taxes on nicotine products and place a new tax on vaping products.

The 2022 California elections took place on November 8, 2022. The statewide direct primary election was held on June 7, 2022.

Colorado Proposition 114 was a ballot measure that was approved in Colorado in the November 2020 elections. It was a proposal to reintroduce the gray wolf back into the state. The proposition was passed with a narrow margin, making Colorado the first US state to pass legislation to reintroduce wildlife.

Proposition 125 was a citizen-initiated, statewide ballot measure that was approved in Colorado on November 8, 2022. The measure allowed for grocery and convenience stores that sell beer to also sell wine.

Proposition 126 was a citizen-initiated, statewide ballot measure that was rejected in Colorado on November 8, 2022. The measure would have allowed alcohol retailers and liquor licensed businesses to offer alcohol delivery through third-party delivery services.

2023 Colorado Proposition HH is a ballot measure that appeared on the Colorado ballot on November 7, 2023. The ballot measure would have made various changes to the state's property tax law. It was rejected by nearly three-fifths of the electorate.