Proposition 13 is an amendment of the Constitution of California enacted during 1978, by means of the initiative process. The initiative was approved by California voters on June 6, 1978 by a nearly two to one margin. It was upheld as constitutional by the United States Supreme Court in the case of Nordlinger v. Hahn, 505 U.S. 1 (1992). Proposition 13 is embodied in Article XIII A of the Constitution of the State of California.

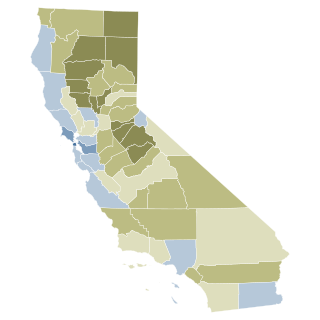

Proposition 209 is a California ballot proposition which, upon approval in November 1996, amended the state constitution to prohibit state governmental institutions from considering race, sex, or ethnicity, specifically in the areas of public employment, public contracting, and public education. Modeled on the Civil Rights Act of 1964, the California Civil Rights Initiative was authored by two California academics, Glynn Custred and Tom Wood. It was the first electoral test of affirmative action policies in North America. It passed with 55% in favor to 45% opposed, thereby banning affirmative action in the state's public sector.

The California state elections, 2006 took place on November 7, 2006. Necessary primary elections were held on June 6. Among the elections that took place were all the seats of the California's State Assembly, 20 seats of the State Senate, seven constitutional officers, and all the seats of the Board of Equalization. Votes on retention of two Supreme Court justices and various Courts of Appeal judges were also held. Five propositions were also up for approval.

California Proposition 87 was a proposition on the ballot for California voters for the November 7, 2006 general election, officially titled Alternative Energy. Research, Production, Incentives. Tax on California Oil Producers. It was rejected by the voters, 54.7% opposed to 45.3% in favor. This was highest-funded campaign on any state ballot and surpassing every campaign in the country in spending except the presidential contest.

Proposition 218 is an adopted initiative constitutional amendment which revolutionized local and regional government finance and taxation in California. Named the "Right to Vote on Taxes Act," it was sponsored by the Howard Jarvis Taxpayers Association as a constitutional follow-up to the landmark property tax reduction initiative constitutional amendment, Proposition 13, approved in June 1978. Proposition 218 was approved and adopted by California voters during the November 5, 1996, statewide general election.

After-school activities, also known as after-school programs or after-school care, started in the early 1900s mainly just as supervision of students after the final school bell. Today, after-school programs do much more. There is a focus on helping students with school work but can be beneficial to students in other ways. An after-school program, today, will not limit its focus on academics but with a holistic sense of helping the student population. An after-school activity is any organized program that youth or adult learner voluntary can participate in outside of the traditional school day. Some programs are run by a primary or secondary school, while others are run by externally funded non-profit or commercial organizations. After-school youth programs can occur inside a school building or elsewhere in the community, for instance at a community center, church, library, or park. After-school activities are a cornerstone of concerted cultivation, which is a style of parenting that emphasizes children gaining leadership experience and social skills through participating in organized activities. Such children are believed by proponents to be more successful in later life, while others consider too many activities to indicate overparenting. While some research has shown that structured after-school programs can lead to better test scores, improved homework completion, and higher grades, further research has questioned the effectiveness of after-school programs at improving youth outcomes such as externalizing behavior and school attendance. Additionally, certain activities or programs have made strides in closing the achievement gap, or the gap in academic performance between white students and students of color as measured by standardized tests. Though the existence of after-school activities is relatively universal, different countries implement after-school activities differently, causing after-school activities to vary on a global scale.

The 2007 Texas constitutional amendment election took place 6 November 2007.

California Proposition 92 was Californian ballot proposition that voters rejected on February 5, 2008. It was a state initiative that would have amended Proposition 98, which set a mandate for the minimum level of funding each year for elementary and secondary schools and for the California Community Colleges.

California's state elections were held November 3, 1998. Necessary primary elections were held on March 3. Up for election were all the seats of the California State Assembly, 20 seats of the California Senate, seven constitutional officers, all the seats of the California Board of Equalization, as well as votes on retention of two Supreme Court justices and various appeals court judges. Twelve ballot measures were also up for approval. Municipal offices were also included in the election.

California's state elections were held November 3, 1992. Necessary primary elections were held on March 3. Up for election were all the seats of the State Assembly, 20 seats of the State Senate, and fifteen ballot measures.

Proposition 1A was a defeated California ballot proposition that appeared on the May 19, 2009 special election ballot. It was a constitutional amendment that would have increased the annual contributions to the state's rainy day fund. The proposition was legislatively referred to voters by the State Legislature.

The California state elections was held on Election Day, November 6, 2012. On the ballot were eleven propositions, various parties' nominees for the United States presidency, the Class I Senator to the United States Senate, all of California's seats to the House of Representatives, all of the seats of the State Assembly, and all odd-numbered seats of the State Senate.

Proposition 29, the California Cancer Research Act, is a California ballot measure that was defeated by California voters at the statewide election on June 5, 2012.

The parcel tax is a form of real estate tax. Unlike most real estate taxes or a land value tax, it is not directly based on property value. It funds K–12 public education and community facilities districts, which are usually known as "Mello-Roos" districts. The California parcel tax, in its typical form as a flat tax, is regressive.

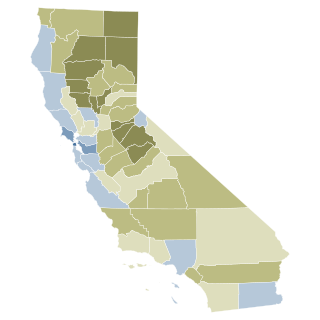

Proposition 30, officially titled Temporary Taxes to Fund Education, is a California ballot measure that was decided by California voters at the statewide election on November 6, 2012. The initiative is a measure to increase taxes to prevent US$6 billion cuts to the education budget for California state schools. The measure was approved by California voters by a margin of 55 to 45 percent.

Steven Mitchell Glazer is an American politician and former political advisor serving as a member of the California State Senate from the 7th Senate District, which includes most of Contra Costa County and eastern portions of Alameda County in the East Bay.

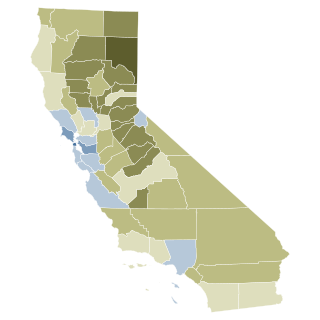

Proposition 55 is a California ballot proposition that passed on the November 8, 2016 ballot, regarding extending by twelve years the temporary personal income tax increases enacted in 2012 on earnings over $250,000, with revenues allocated to K–12 schools, California Community Colleges, and, in certain years, healthcare. Proposition 55 will raise tax revenue by between $4 billion and $9 billion a year. Half of funds will go to schools and community colleges, up to $2 billion a year would go to Medi-Cal, and up to $1.5 billion will be saved and applied to debt.

California state elections in 2018 were held on Tuesday, November 6, 2018, with the primary elections being held on June 5, 2018. Voters elected one member to the United States Senate, 53 members to the United States House of Representatives, all eight state constitutional offices, all four members to the Board of Equalization, 20 members to the California State Senate, and all 80 members to the California State Assembly, among other elected offices.

Proposition 13 was a failed California ballot proposition on the March 3, 2020, ballot that would have authorized the issuance of $15 billion in bonds to finance capital improvements for public and charter schools statewide. The proposition would have also raised the borrowing limit for some school districts and eliminated school impact fees for multifamily housing near transit stations.

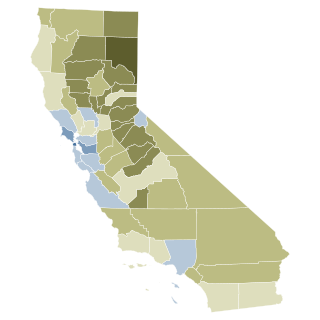

California Proposition 15 was a failed citizen-initiated proposition on the November 3, 2020, ballot. It would have provided $6.5 billion to $11.5 billion in new funding for public schools, community colleges, and local government services by creating a "split roll" system that increased taxes on large commercial properties by assessing them at market value, without changing property taxes for small business owners or residential properties for homeowners or renters. The measure failed by a small margin of about four percentage points.