Proposition 13 is an amendment of the Constitution of California enacted during 1978, by means of the initiative process. The initiative was approved by California voters on June 6, 1978. It was upheld as constitutional by the United States Supreme Court in the case of Nordlinger v. Hahn, 505 U.S. 1 (1992). Proposition 13 is embodied in Article XIII A of the Constitution of the State of California.

In California, a ballot proposition is a referendum or an initiative measure that is submitted to the electorate for a direct decision or direct vote. If passed, it can alter one or more of the articles of the Constitution of California, one or more of the 29 California Codes, or another law in the California Statutes by clarifying current or adding statute(s) or removing current statute(s).

The Taxpayer Bill of Rights is a concept advocated by conservative and free market libertarian groups, primarily in the United States, as a way of limiting the growth of government. It is not a charter of rights but a provision requiring that increases in overall tax revenue be tied to inflation and population increases unless larger increases are approved by referendum.

The California special election of 2005 was held on November 8, 2005 after being called by Governor Arnold Schwarzenegger on June 13, 2005.

Proposition 218 is an adopted initiative constitutional amendment which revolutionized local and regional government finance and taxation in California. Named the "Right to Vote on Taxes Act," it was sponsored by the Howard Jarvis Taxpayers Association as a constitutional follow-up to the landmark property tax reduction initiative constitutional amendment, Proposition 13, approved in June 1978. Proposition 218 was approved and adopted by California voters during the November 5, 1996, statewide general election.

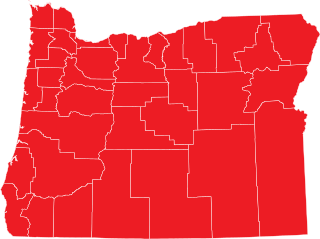

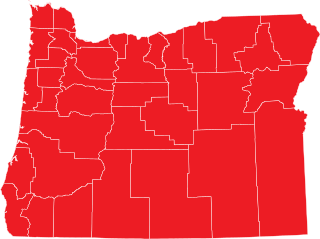

Oregon ballot measure 48 was one of two unsuccessful ballot measures sponsored by the Taxpayers Association of Oregon (TAO) on the November 7, 2006 general election ballot. Measure 48 was an initiated constitutional amendment ballot measure. Oregon statute currently limits state appropriations to 8% of projected personal income in Oregon. If Governor declares emergency, legislature may exceed current statutory appropriations limit by 60% vote of each house. This measure would have added a constitutional provision limiting any increase in state spending from one biennium to next biennium to the percentage increase in state population, plus inflation, over previous two years. Certain exceptions to limit, including spending of: federal, donated funds; proceeds from selling certain bonds, real property; money to fund emergency funds; money to fund tax, "kicker," other refunds were included in the provisions of the measure. It also would have provided that spending limit may be exceeded by amount approved by two-thirds of each house of legislature and approved by majority of voters voting in general election.

The 2007 Texas constitutional amendment election took place 6 November 2007.

California Proposition 91 was a failed proposal to amend the California Constitution to prohibit motor vehicle fuel sales taxes that are earmarked for transportation purposes from being retained in the state's general fund. The proposition appeared on the ballot of the February primary election.

California's state elections were held November 2, 2004. Necessary primary elections were held on March 2. Up for election were all the seats of the State Assembly, 20 seats of the State Senate, and sixteen ballot measures.

California's state general elections were held November 5, 1996. Necessary primary elections were held on March 26, 1996. Up for election were all eighty (80) seats of the State Assembly, twenty (20) seats of the State Senate, and fifteen (15) statewide ballot measures.

Taxes in California are collected by state and local governments through a number of tax categories.

2015 Michigan Proposal 1, also known as the Michigan Sales Tax Increase for Transportation Amendment, was a referendum held on May 5, 2015, concerning a legislatively-referred ballot measure. The measure's approval would have caused one constitutional amendment and 10 statutes to go into effect. It is estimated that Proposal 1 would raise state revenues from sales and use taxes by $1.427 billion, fuel taxes by $463 million, truck registration fees by $50 million, and vehicle registration fees by $10.1 million in the first year. If approved, the proposal was estimated by the Associated Press to result in an average tax increase of $545 per household in 2016.

Proposition 218 is an adopted initiative constitutional amendment in the state of California that appeared on the November 5, 1996, statewide election ballot. Proposition 218 revolutionized local and regional government finance in California. Called the “Right to Vote on Taxes Act,” Proposition 218 was sponsored by the Howard Jarvis Taxpayers Association as a constitutional follow-up to the landmark Proposition 13 property tax revolt initiative constitutional amendment approved by California voters on June 6, 1978. Proposition 218 was drafted by constitutional attorneys Jonathan Coupal and Jack Cohen.

The Road Repair and Accountability Act of 2017, also known as the "Gas Tax", is a California legislative bill that was passed on April 6, 2017 with the aim of repairing roads, improving traffic safety, and expanding public transit systems across the state. The approval of the fuel tax was for a projected $52.4 billion, or $5.24 billion per year, to be raised over the next 10 years to fund the state's infrastructure. The bill passed primarily along party lines, with most Democrats supporting the bill while most Republicans were against it. The bill passed with a vote of 27–11 in the Senate and 54–26 in the Assembly. According to California Department of Transportation, for maintenance projects on state highways, while providing funding to enhance trade corridors, transit, and active transportation facilities, in addition to repairing local streets and roads throughout California.

California state elections in 2018 were held on Tuesday, November 6, 2018, with the primary elections being held on June 5, 2018. Voters elected one member to the United States Senate, 53 members to the United States House of Representatives, all eight state constitutional offices, all four members to the Board of Equalization, 20 members to the California State Senate, and all 80 members to the California State Assembly, among other elected offices.

California Proposition 6 was a measure that was submitted to California voters as part of the November 2018 election. The ballot measure proposed a repeal of the Road Repair and Accountability Act, which is also known as Senate Bill 1. The measure failed with about 57% of the voters against and 43% in favor.

California Proposition 19 (2020), also referred to as Assembly Constitutional Amendment No. 11, is an amendment of the Constitution of California that was narrowly approved by voters in the general election on November 3, 2020, with just over 51% of the vote. The legislation increases the property tax burden on owners of inherited property to provide expanded property tax benefits to homeowners ages 55 years and older, disabled homeowners, and victims of natural disasters, and fund wildfire response. According to the California Legislative Analyst, Proposition 19 is a large net tax increase "of hundreds of millions of dollars per year."

On November 8, 2016, Illinois voters approved the Illinois Transportation Taxes and Fees Lockbox Amendment, a legislatively referred constitutional amendment that prohibits lawmakers from using transportation funds for anything other than their stated purpose.