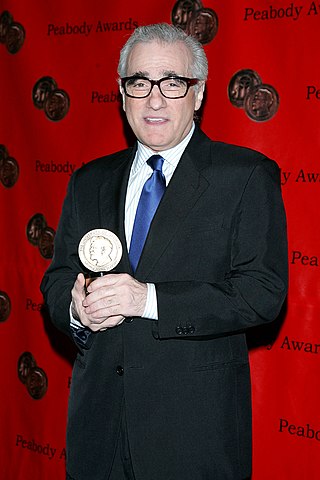

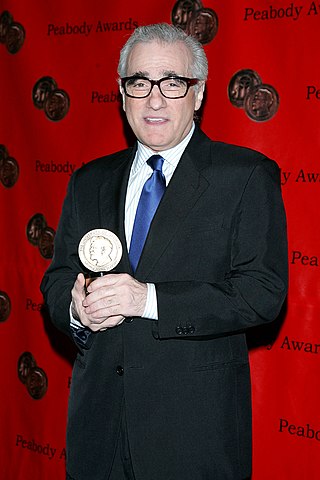

Martin Charles Scorsese is an American filmmaker. He emerged as one of the major figures of the New Hollywood era. He has received many accolades, including an Academy Award, four BAFTA Awards, three Emmy Awards, a Grammy Award, and three Golden Globe Awards. He has been honored with the AFI Life Achievement Award in 1997, the Film Society of Lincoln Center tribute in 1998, the Kennedy Center Honor in 2007, the Cecil B. DeMille Award in 2010, and the BAFTA Fellowship in 2012. Four of his films have been inducted into the National Film Registry by the Library of Congress as "culturally, historically or aesthetically significant".

Roger & Me is a 1989 American documentary film written, produced, directed by, and starring Michael Moore, in his directorial debut. Moore portrays the regional economic impact of General Motors CEO Roger Smith's action of closing several auto plants in his hometown of Flint, Michigan, reducing GM's employees in that area from 80,000 in 1978 to about 50,000 in 1992.

Dan Georgakas was an American anarchist poet and historian, who specialized in oral history and the American labor movement, best known for the publication Detroit: I do mind dying: A study in urban revolution (1975), which documents African-American radical groups in Detroit during the 1960s and 1970s.

Gordon Gekko is a composite character in the 1987 film Wall Street and its 2010 sequel Wall Street: Money Never Sleeps, both directed by Oliver Stone. Gekko was portrayed in both films by actor Michael Douglas, who won the Academy Award for Best Actor for his performance in the first film. In 2003, the American Film Institute named Gordon Gekko No. 24 on its Top 50 movie villains of all time.

Terence Patrick Winter is an American writer and producer of television and film. He was the creator, writer, and executive producer of the HBO television series Boardwalk Empire (2010–2014). Before creating Boardwalk Empire, Winter was a writer and executive producer for the HBO television series The Sopranos, from the show's second to sixth and final season (2000–2007).

Stratton Oakmont, Inc. was a Long Island, New York, over-the-counter brokerage house founded in 1989 by Jordan Belfort and Danny Porush. It defrauded many shareholders, leading to the arrest and incarceration of several executives and the closing of the firm in 1996.

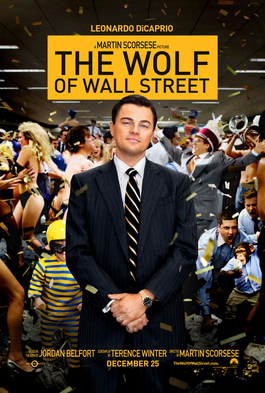

Jordan Ross Belfort is an American former stockbroker, financial criminal, and businessman who pleaded guilty to fraud and related crimes in connection with stock-market manipulation and running a boiler room as part of a penny-stock scam in 1999. Belfort spent 22 months in prison as part of an agreement under which, becoming an informant for the FBI and wearing a wire, he gave testimony against numerous partners and subordinates in his fraud scheme. He published the memoir The Wolf of Wall Street in 2007, which was adapted into Martin Scorsese's film of the same name released in 2013, in which he was played by Leonardo DiCaprio.

The Wolf of Wall Street may refer to:

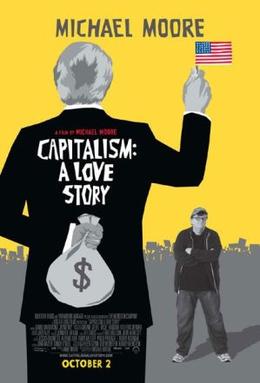

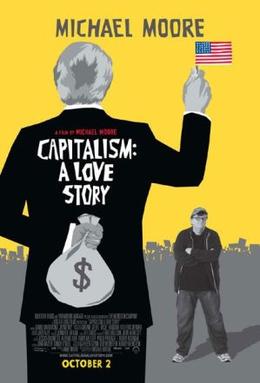

Capitalism: A Love Story is a 2009 American documentary film directed, written by, and starring Michael Moore. The film centers on the 2007–2008 financial crisis and the recovery stimulus, while putting forward an indictment of the then-current economic order in the United States and of unfettered capitalism in general. Topics covered include Wall Street's "casino mentality", for-profit prisons, Goldman Sachs' influence in Washington, D.C., the poverty-level wages of many workers, the large wave of home foreclosures, corporate-owned life insurance, and the consequences of "runaway greed". The film also features a religious component in which Moore examines whether or not capitalism is a sin and whether Jesus would be a capitalist; this component highlights Moore's belief that evangelical conservatives contradict themselves by supporting free market ideals while professing to be Christians.

Appian Way Productions is an American film and television production company founded in 2001 by actor and producer Leonardo DiCaprio. Since its launch, Appian Way has released a diverse slate of films, including Academy Award–winning films The Aviator (2004) and The Revenant (2015), and Academy Award–nominated films The Ides of March (2011) and The Wolf of Wall Street (2013). The company has also produced television series such as The Right Stuff (2020) for Disney+.

Financial thrillers are a subgenre of thriller fiction in which the financial system and economy play a major role.

Red Granite Pictures was an American film production and distribution company, co-founded by Riza Aziz and Joey McFarland in 2010. Its productions included The Wolf of Wall Street and Dumb and Dumber To. It was dissolved in 2018 after being implicated in the 1Malaysia Development Berhad corruption scandal.

Leonardo DiCaprio is an American actor who began his career performing as a child on television. He appeared on the shows The New Lassie (1989) and Santa Barbara (1990) and also had long-running roles in the comedy-drama Parenthood (1990) and the sitcom Growing Pains (1991). DiCaprio played Tobias "Toby" Wolff opposite Robert De Niro in the biographical coming-of-age drama This Boy's Life in 1993. In the same year, he had a supporting role as a developmentally disabled boy Arnie Grape in What's Eating Gilbert Grape, which earned him nominations for the Academy Award for Best Supporting Actor and the Golden Globe Award for Best Supporting Actor – Motion Picture. In 1995, DiCaprio played the leading roles of an American author Jim Carroll in The Basketball Diaries and the French poet Arthur Rimbaud in Total Eclipse. The following year he played Romeo Montague in the Baz Luhrmann-directed film Romeo + Juliet (1996). DiCaprio starred with Kate Winslet in the James Cameron-directed film Titanic (1997). The film became the highest grossing at the worldwide box-office, and made him famous globally. For his performance as Jack Dawson, he received the MTV Movie Award for Best Male Performance and his first nomination for the Golden Globe Award for Best Actor – Motion Picture Drama.

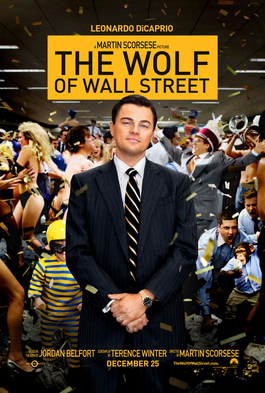

The Wolf of Wall Street is a 2013 American biographical black comedy-drama film co-produced and directed by Martin Scorsese and written by Terence Winter, based on Jordan Belfort's 2007 memoir. It recounts Belfort's career as a stockbroker in New York City and how his firm, Stratton Oakmont, engaged in rampant corruption and fraud on Wall Street, leading to his downfall. The film stars Leonardo DiCaprio as Belfort; Jonah Hill as his business partner and friend Donnie Azoff; Margot Robbie as his second wife, Naomi Lapaglia; Matthew McConaughey as his mentor and former boss Mark Hanna; and Kyle Chandler as FBI agent Patrick Denham. It is DiCaprio's fifth collaboration with Scorsese.

Daniel Mark Porush is an American businessman, former stock broker and convicted criminal who helped run a pump and dump stock fraud scheme in the 1990s at the Stratton Oakmont brokerage in collaboration with Jordan Belfort. In 1999, he was convicted of securities fraud and money laundering, for which he served 39 months in prison. After prison, Porush became involved with a Florida-based medical supply company, Med-Care, which was the subject of federal investigations. In the biographical 2013 film The Wolf of Wall Street, which focuses on the story of Belfort and Stratton Oakmont, Jonah Hill portrays Donnie Azoff, a character loosely based on Porush. Porush has called the portrayal inaccurate and threatened to sue the filmmakers to prevent him from being depicted.

Riza Shahriz bin Abdul Aziz, better known as Riza Aziz, is a Malaysian film producer and the co-founder of Red Granite Pictures, a Los Angeles–based film production company.

The Wolf of Wall Street is a memoir by former stockbroker and trader Jordan Belfort, first published in September 2007 by Bantam Books, then adapted into a 2013 film of the same name. Belfort's autobiographical account was continued by Catching the Wolf of Wall Street, published in 2009.

Martin Scorsese and Leonardo DiCaprio are frequent collaborators in cinema, with DiCaprio appearing in six feature films and one short film made by Scorsese since 2002. The films explore a variety of genres, including historical epic, crime, thriller, biopic, comedy, and western. Several have been listed on many critics' year-end top ten and best-of-decade lists.

The Wolf of Wall Street: Music from the Motion Picture is the soundtrack to the Martin Scorsese-directed 2013 epic biographical black comedy crime film of the same name released on December 17, 2013, for digital download and through physical CDs and vinyl editions on January 7, 2014, distributed by Virgin Records. The album features a roster of mid-century blues tracks from popular artists during the 1950s and 1960s. The music received critical acclaim and received a nomination for Grammy Award for Best Compilation Soundtrack for Visual Media, though lost to the soundtrack of Frozen (2013).