Health care reform is for the most part governmental policy that affects health care delivery in a given place. Health care reform typically attempts to:

Publicly funded healthcare is a form of health care financing designed to meet the cost of all or most healthcare needs from a publicly managed fund. Usually this is under some form of democratic accountability, the right of access to which are set down in rules applying to the whole population contributing to the fund or receiving benefits from it.

Health insurance or medical insurance is a type of insurance that covers the whole or a part of the risk of a person incurring medical expenses. As with other types of insurance, risk is shared among many individuals. By estimating the overall risk of health risk and health system expenses over the risk pool, an insurer can develop a routine finance structure, such as a monthly premium or payroll tax, to provide the money to pay for the health care benefits specified in the insurance agreement. The benefit is administered by a central organization, such as a government agency, private business, or not-for-profit entity.

Two-tier healthcare is a situation in which a basic government-provided healthcare system provides basic care, and a secondary tier of care exists for those who can pay for additional, better quality or faster access. Most countries have both publicly and privately funded healthcare, but the degree to which it creates a quality differential depends on the way the two systems are managed, funded, and regulated.

Long-term care insurance is an insurance product, sold in the United States, United Kingdom and Canada that helps pay for the costs associated with long-term care. Long-term care insurance covers care generally not covered by health insurance, Medicare, or Medicaid.

Switzerland has universal health care, regulated by the Swiss Federal Law on Health Insurance. There are no free state-provided health services, but private health insurance is compulsory for all persons residing in Switzerland.

Health care prices in the United States of America describe market and non-market factors that determine pricing, along with possible causes as to why prices are higher than in other countries.

The Massachusetts health care reform, commonly referred to as Romneycare, was a healthcare reform law passed in 2006 and signed into law by Governor Mitt Romney with the aim of providing health insurance to nearly all of the residents of the Commonwealth of Massachusetts.

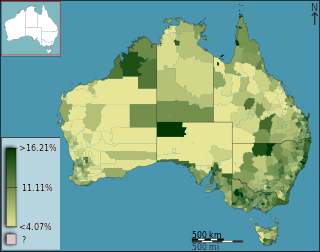

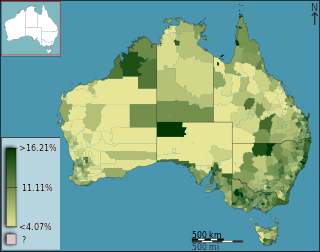

Health care in Australia operates under a shared public-private model underpinned by the Medicare system, the national single-payer funding model. State and territory governments operate public health facilities where eligible patients receive care free of charge. Primary health services, such as GP clinics, are privately owned in most situations, but attract Medicare rebates. Australian citizens, permanent residents, and some visitors and visa holders are eligible for health services under the Medicare system. Individuals are encouraged through tax surcharges to purchase health insurance to cover services offered in the private sector, and further fund health care.

Healthcare in the Netherlands is differentiated along three dimensions (1) level (2) physical versus mental and (3) short term versus long term care.

Healthcare in Singapore is under the purview of the Ministry of Health of the Government of Singapore. It mainly consists of a government-run publicly funded universal healthcare system as well as a significant private healthcare sector. Financing of healthcare costs is done through a mixture of direct government subsidies, compulsory comprehensive savings, national healthcare insurance, and cost-sharing.

Germany has a universal multi-payer health care system paid for by a combination of statutory health insurance and private health insurance.

Healthcare in Turkey consists of a mix of public and private health services. Turkey introduced universal health care in 2003. Known as Universal Health Insurance Genel Sağlık Sigortası, it is funded by a tax surcharge on employers, currently at 5%. Public-sector funding covers approximately 75.2% of health expenditures.

Healthcare in South Korea is universal, although a significant portion of healthcare is privately funded. South Korea's healthcare system is based on the National Health Insurance Service, a public health insurance program run by the Ministry of Health and Welfare to which South Koreans of sufficient income must pay contributions in order to insure themselves and their dependants, and the Medical Aid Program, a social welfare program run by the central government and local governments to insure those unable to pay National Health Insurance contributions. In 2015, South Korea ranked first in the OECD for healthcare access. Satisfaction of healthcare has been consistently among the highest in the world – South Korea was rated as the second most efficient healthcare system by Bloomberg. Health insurance in South Korea is single-payer system. The introduction of health insurance resulted in a significant surge in the utilization of healthcare services. Healthcare providers are overburdened by government taking advantage of them.

Healthcare in Georgia is provided by a universal health care system under which the state funds medical treatment in a mainly privatized system of medical facilities. In 2013, the enactment of a universal health care program triggered universal coverage of government-sponsored medical care of the population and improving access to health care services. Responsibility for purchasing publicly financed health services lies with the Social Service Agency (SSA).

Examples of health care systems of the world, sorted by continent, are as follows.

Healthcare in Luxembourg is based on three fundamental principles: compulsory health insurance, free choice of healthcare provider for patients and compulsory compliance of providers in the set fixed costs for the services rendered. Citizens are covered by a healthcare system that provides medical, maternity and illness benefits and, for the elderly, attendance benefits. The extent of the coverage varies depending on the occupation of the individual. Those employed or receiving social security have full insurance coverage, and the self-employed and tradesmen are provided with both medical benefits and attendance benefits. That is all funded by taxes on citizens' incomes, payrolls and wages. However, the government covers the funding for maternity benefits as well as any other sector that needs additional funding. About 75% of the population purchases a complementary healthcare plan. About 99% of the people are covered under the state healthcare system.

Government-guaranteed health care for all citizens of a country, often called universal health care, is a broad concept that has been implemented in several ways. The common denominator for all such programs is some form of government action aimed at broadly extending access to health care and setting minimum standards. Most implement universal health care through legislation, regulation, and taxation. Legislation and regulation direct what care must be provided, to whom, and on what basis.

Health care finance in the United States discusses how Americans obtain and pay for their healthcare, and why U.S. healthcare costs are the highest in the world based on various measures.

India has a multi-payer universal health care model that is paid for by a combination of public and government regulated private health insurances along with the element of almost entirely tax-funded public hospitals. The public hospital system is essentially free for all Indian residents except for small, often symbolic co-payments in some services. Economic Survey 2022-23 highlighted that the Central and State Governments’ budgeted expenditure on the health sector reached 2.1% of GDP in FY23 and 2.2% in FY22, against 1.6% in FY21. India ranks 78th and has one of the lowest healthcare spending as a percent of GDP. It ranks 77th on the list of countries by total health expenditure per capita.